- Trade Treasury Payments | The Liquidity Brief

- Posts

- Welcome to the TTP Liquidity Brief | Issue 10

Welcome to the TTP Liquidity Brief | Issue 10

Curb your Monday blues with our liquidity brief. The only newsletter in liquidity and risk management that you need to subscribe to. For the hustler, the CEO, the intern, the MD. Prepare for your week ahead, with the biggest voices, heavyweight leaders, and the meaningful conversations in trade, treasury, and payments. No spin, no bias, no gatekeeping—just honest, high-value insights.

🌟 Editor's note

Editor’s Note | Week of 23 June 2025

It’s not often that trade headlines are made in Windhoek. But this week, the Namibian capital became a focal point for global commerce, hosting the first-ever Commonwealth Trade Ministers Meeting and Business Summit on African soil. TTP was proud to serve as a media partner, covering some of the summit's policy outcomes and structural gaps, bringing together 56 countries, accounting for 2.6 billion people, and nearly 15% of global gross domestic product (GDP).

Among the leaders spotlighted were Her Excellency Dr Netumbo Nandi Ndaitwah, Namibia’s Vice President, who opened proceedings with a powerful defence of regional integration; and Wamkele Mene, Secretary-General of the AfCFTA, who made the case for better alignment between pan-African trade infrastructure and Commonwealth ambitions. In one of the week’s most memorable moments, Namibia’s Minister of International Relations, Selma Ashipala-Musavyi, reminded delegates that no credible trade strategy can ignore climate realities, particularly for countries most vulnerable to ecological disruption.

Trade between member states benefits from a “Commonwealth advantage,” with costs on average 21% lower due to shared legal systems, language, and institutional familiarity.

Our slow read this week digs into a new research paper by Elvira Bobillo-Carballo and Alfredo Arahuetes García, showing how trade finance shortfalls, now estimated at $2.5 trillion annually, are largely the result of underused credit risk mitigants. Based on interviews with 38 trade finance bankers across four continents, the paper reveals that ECAs, MDB guarantees, and trade credit insurance are routinely bypassed or misunderstood. In West Africa alone, rejection rates hit 25% by value, particularly in markets like Ghana, Nigeria, and Senegal.

That story complements our continuing coverage of regulation and risk, including the latest developments in supply chain sustainability laws across Europe, where companies face a tightening web of ESG-related obligations. As supply chain finance becomes more central to corporate sustainability reporting, these rules will increasingly shape treasury and finance operations.

On the payments and treasury front, our readers will find insight from Money20/20 Europe, where embedded payments, AI-led infrastructure, and platform interoperability stole the show. We covered Uber’s potential move into stablecoins for cross-border transfers, Bank of America’s $$10 million RTP cap increase, and the launch of GTreasury’s GSmart AI treasury solution.

Meanwhile, SWIFT’s latest RMB Tracker revealed a sharp 23% drop in renminbi usage, with the currency falling behind the Canadian dollar in global payment rankings. Hong Kong now handles over 75% of offshore RMB flows, underscoring China’s continued reliance on a single financial hub.

TTP spoke to SWIFT’s Shriyanka Hore at a Commonwealth live stream, addressing this fragmentation head-on, warning that trade frictions could shave $6.5 trillion off global GDP by 2030. In a world of proliferating platforms and diverging regulations, SWIFT’s role, she argued, is not to finance trade, but to keep it interoperable. Her call to arms? Harmonise digital trade laws, adopt ISO 20022 at scale, and ensure no country is left behind.

From TTP, we’re thrilled to announce the launch of the TTP Breakfast Club, a curated, invite-only roundtable series for senior leaders in trade, treasury and transaction banking. And looking ahead to Sibos Frankfurt, we’re setting sail with the Surecomp x TTP Boat Party (during Sibos) in Frankfurt on 30 September. Mark your calendars.

Also worth celebrating: TTP just passed 3,000 followers across our social platforms, with new video reels this week featuring Valerie Neim (Invictae), Luca Castellani (UNCITRAL), and Anil Bhardwaj (FISME).

As we look ahead to the FCI Annual Conference in Rio, our editorial team will be on the ground covering the latest in factoring and SCF. It’s a fitting moment to revisit our earlier explainer on global factoring statistics, where Africa and Latin America remain underrepresented despite strong potential. Also this week: we’re proud to partner with the ADB and EBRD as they convene a Women in Trade workshop in Tashkent. We’ll be reporting from there too, continuing our commitment to spotlighting access, equity, and finance at every level of the trade ecosystem.

Until next week—keep turning the tide.

— The Editors

Skip to your favourite part

Slow read

Every year, $2.5 trillion in global trade deals fail to materialise due to a lack of funding. This funding gap, representing a tenth of all global merchandise trade, persists not because solutions don’t exist, but because banks systematically ignore risk management tools that are easily available and accessible, says the research article published in Global Policy.

The article is authored by researchers Elvira Bobillo-Carballo and Alfredo Arahuetes García, who conducted extensive interviews with 38 senior trade finance bankers across 4 continents, uncovering regulatory hurdles, organisational challenges, and human bias that leaves trillions in potential business unfunded.

The researchers documented dozens of cases where financial institutions rejected viable transactions despite having tools to mitigate the associated risks, concluding that banks consistently fail to use Credit Risk Mitigants (CRM) efficiently.

The implications extend far beyond banking. For manufacturers in Bangladesh, farmers in Nigeria, and exporters in Pakistan, this financing gap translates directly to stalled economic development, unrealised job creation, and poverty in regions most desperate for growth.

Developing economies shoulder the global trade burden

The research article notes that the trade finance gap carves deepest trenches across developing regions. Asia and the Pacific absorb 34% of global trade finance rejections, with the Asian Development Bank estimating the regional gap at hundreds of billions of dollars.

Africa and the Middle East face another 24% of rejections, creating economic dead zones where trade withers for lack of financing.

West African nations face particularly stark challenges. The Economic Community of West African States, including Côte d’Ivoire, Ghana, Nigeria and Senegal contend with a staggering $14 billion annual trade finance shortfall. Rejection rates reach 21% of requests and 25% of their total value, effectively slamming doors on economic development.

Region | Share of Global Trade Finance Rejections | Commonly Cited Problematic Countries |

Asia and the Pacific | 34% | Bangladesh, Pakistan |

Africa and the Middle East | 24% | Nigeria, Egypt |

West Africa (ECOWAS) | 21% | Ghana, Côte d’Ivoire, Senegal |

Bankers have repeatedly flagged Bangladesh, Egypt, Nigeria, and Pakistan as problematic for trade finance. Senior bankers revealed a pattern of casual dismissal that hampers developing economies, with many simply declining transactions when they lack established credit lines. Others admitted focusing exclusively on larger transactions while ignoring smaller deals from small and medium enterprises (SMEs).

This geographic inequity creates a self-reinforcing cycle, as these nations have the potential to contribute to global economic growth. Many of these countries feature younger populations, expanding consumer markets, and untapped resources. Yet the trade finance gap effectively locks them out of full participation in global commerce.

Banks are rejecting the golden touch of risk

According to the Bank for International Settlements, approximately 15% of global merchandise trade relies on letters of credit (LoC), with this percentage substantially higher in emerging economies. However, despite their proven track record, confirming banks increasingly reject these instruments in precisely the markets where they are most vital. They cite unacceptable credit and country risks, more like a financial euphemism that often masks institutional inertia rather than genuine risk assessment.

However, there is no doubt that the banking industry possesses risk mitigation tools for trade finance risk, but most of them remain unutilised. Some of these tools are specifically marked in the research article. It includes:

Export Credit Agencies (ECAs): They offer the strongest protection, government guarantees covering 95-100% of payment risk, but only 15% of bankers use them. As per the research article, many veteran bankers admitted complete ignorance that ECAs even offer short-term products, while Berne Union data shows ECAs underwrote 45% of the $2.78 trillion in global credit insurance last year.

Trade credit insurance: They provide a market alternative, with 60 commercial players ready to absorb up to 90% of risk. Though 42% of bankers use this option, most resist, citing cost concerns. Trade finance heads complain about insurers taking margin slices, missing the bigger picture: more deals, even at lower margins, mean more revenue. ICISA reports private insurers backed 72% of short-term trade credit coverage in 2023, a capacity that sits largely unused.

Multilateral Development Banks (MDBs): For frontier markets, multilateral development banks offer specialised guarantees through the World Bank’s IFC and regional institutions. Only 25% of bankers tap these resources, with barely a third aware they exist. Bureaucracy kills these deals as approval processes stretch six to eighteen months, outlasting commercial opportunities. MDBs contributed just $7.3 billion to trade finance in 2022, far below their potential.

Bank-to-bank risk sharing: This emerges as the industry favourite, with 48% distributing risk to peers using standardised agreements. Yet even here, image concerns trump business sense. Bankers routinely keep 10% of deals they’d rather fully offload, fearing market whispers about their risk appetite.

Photo of the week

The Secretary-General of the African Continental Free Trade Area (AfCFTA) H.E. Wamkele Mene, delivering a keynote speech at The Commonwealth Trade Ministers Meeting and Business Summit, Windhoek, Namibia.

Trade digest

Treasury & FX digest

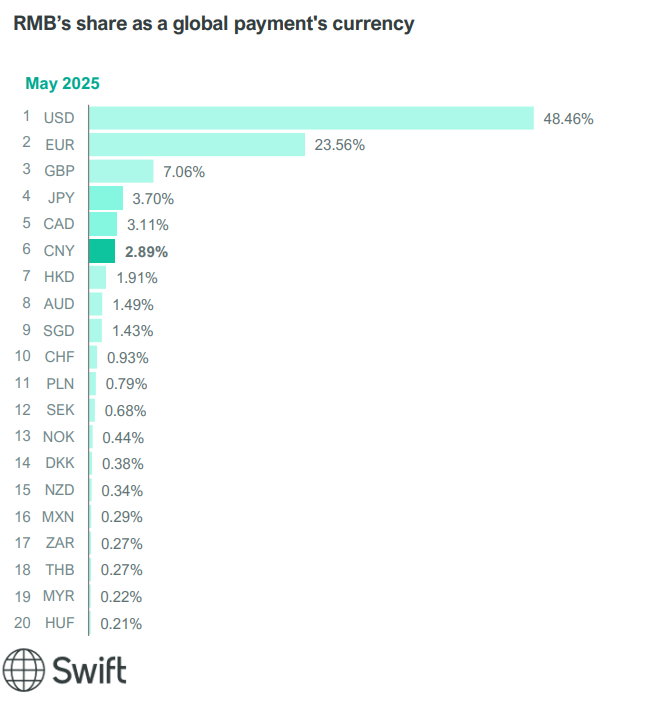

The Chinese renminbi (RMB) has suffered a substantial setback in its internationalisation efforts, according to the latest SWIFT RMB Tracker report released today for the month of May. The currency has dropped one position to become the sixth most active currency for global payments by value, with its market share declining to 2.89%.

The SWIFT RMB Tracker is published monthly and provides statistics on renminbi usage in international payments, trade finance, and foreign exchange markets based on transaction data from more than 11,000 financial institutions across 200 countries and territories.

Data from this report indicates that RMB payments value decreased by 23.07% compared to April 2025, a dramatic decline that far outpaced the general market contraction of 6.81% observed across all payment currencies.

This is a significant reversal in the currency’s international standing. The RMB has now fallen behind the Canadian dollar, which holds 3.11% of global payment share.

The bigger picture: The global payments landscape remains dominated by USD

The U.S. dollar continues its overwhelming dominance in global payments, commanding 48.46% of all transactions by value. The euro follows at 23.56%, with the British pound (7.06%), Japanese yen (3.70%), and Canadian dollar (3.11%) completing the top five positions.

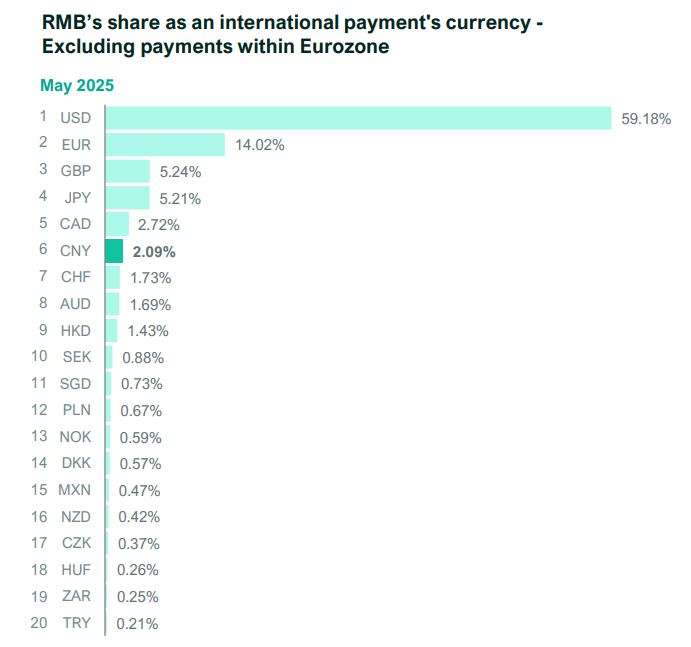

When excluding payments within the Eurozone, the renminbi maintains its sixth position with a 2.09% share of international payments. This metric provides a clearer picture of truly international transactions by removing intra-European payments that might otherwise inflate the euro’s standing.

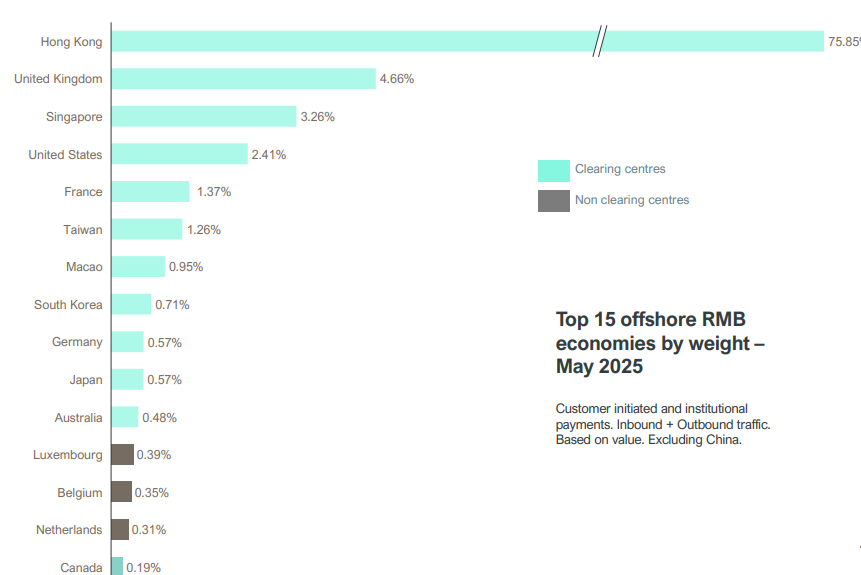

Singular dependence: Hong Kong controls China’s offshore currency future

The report reveals Hong Kong’s overwhelming dominance in offshore RMB transactions, processing 75.85% of all activity by value. This concentration has remained relatively stable over the past five years, as shown in SWIFT’s historical data tracking. The United Kingdom (4.66%), Singapore (2.41%), and the United States (0.95%) collectively handle less than 8% of offshore RMB transactions. It is also 16 times more than the nearest competitor, which is the UK.

Hong Kong has consistently maintained a 70-80% share of offshore RMB payments since at least 2020, with only minor fluctuations despite China’s efforts to diversify its currency’s international presence. This shows the RMB’s dependence on Hong Kong as China’s primary financial gateway to international markets.

The historical data also shows a significant concentration of RMB activity in Hong Kong over time, with limited diversification to other financial centres.

Payments digest

🗓️ Upcoming events

Featured events by TTP

Partner events

FCI Annual Conference Rio will host the FCI Annual Conference, covering the latest in factoring and Supply Chain Finance.

| UN 4th International Conference on Financing for Development Sevilla will host the FFD4, to reform financing at all levels.

|

ICC Mexican Trade Finance Day

| ITFA Week Day 1

|

ITFA Week Day 2 and 3

| ITFA Annual Conference

|

ADB Annual Awards and Dinner

| SME Finance Forum

|

Sibos

| TTP Boat Cruise at Sibos

|

Multimedia from Trade Treasury Payments

Videos

Reels

Livestreams

Report - Out now!

Read our series: Trade digitisation’s bumpy road to interoperability

🏆 Meet the Global Advisory Panel (GAP)

| Kalyan Basu, India Tradetech Advisory Panel MemberDaily Mission

Behind the Scenes

Life Mantras

|

🏆 Company Spotlight (GAP)

Elevator pitch:

GTreasury is one of the few platforms that live up to modern treasury operations' complexity. From cash and risk to payments and liquidity, it runs mission-critical workflows for some of the world’s most demanding CFOs — and across 160+ countries. It’s built for speed, control, and transparency in environments where decisions can’t wait.

Spot the difference:

Most treasury systems still rely on manual processes and siloed data. GTreasury offers end-to-end visibility, automation, and real-time intelligence. Its latest addition, GSmart AI (launched last week), is a secure, purpose-built AI platform that flags risks, performs time-consuming tasks, and recommends next steps. Unlike off-the-shelf AI tools, GSmart was explicitly developed for treasury users, providing explainability, audit trails, and full control over data and decisions.

Fun fact:

GTreasury’s platform sees $46 trillion in cash movements annually across 160+ countries. The GSmart AI rollout marks one of the first major attempts to embed explainable, actionable AI into treasurers' day—to—day toolkit without sacrificing compliance or control.

Did You Know? The Commonwealth may not be perfect, but it collectively represents 2.6 billion people and nearly one-third of global GDP — not bad for an organisation born out of post-colonial diplomacy and cricket rivalries.

Till next time,