- Trade Treasury Payments | The Liquidity Brief

- Posts

- Welcome to the TTP Liquidity Brief | Issue 21

Welcome to the TTP Liquidity Brief | Issue 21

Curb your Monday blues with our liquidity brief. The only newsletter in liquidity and risk management that you need to subscribe to. For the hustler, the CEO, the intern, the MD. Prepare for your week ahead, with the biggest voices, heavyweight leaders, and the meaningful conversations in trade, treasury, and payments. No spin, no bias, no gatekeeping—just honest, high-value insights.

🌟 Editor's note

Editor’s Note | Week of 8 September 2025

Factoring and finance in a new trade geography

This week’s issue explores the quiet forces reshaping global trade and its financing. As traditional supply chains fragment under geopolitical pressure, new corridors are emerging, backed by infrastructure, digital rails, and shifting alliances.

We reported mostly from the ground in Singapore, where TTP captured insights from leaders across Asia Pacific, including the ADB, ITFA, ICC, Komgo, and BAFT. Across dozens of interviews, roundtables, and workshops, one theme emerged: partnership is driving progress, and redefining the rules of trade.

Here’s what’s covered

In Trade:

FCI & MonetaGo on rerouted trade corridors: Factoring adapts to China’s export shift to the Global South, with strategic ports and trade infrastructure supporting new flows.

ITFA’s Emerging Leaders Awards: Alena Malgina, Aziz Kakhkharov, and Sanjana Gulwaney highlight new thinking in digitisation, pricing models, and climate-linked SME finance.

Sustainable SCF explained: We unpack how real-world ESG-linked finance structures are taking shape in Asia and beyond.

FIT-P trade alliance: Singapore, UAE, and others form a new pact for investment, amid multilateral gridlock.

The ITFA–ICC DSI partnership bears fruit: The Digital Negotiable Instruments (DNI) standard is now part of ICC’s KTDDE framework.

In Treasury & Payments:

Atlar x HSBC Innovation Banking: New API-driven partnership delivers modern treasury tools for growing companies.

Climate retreat in banking: The Net-Zero Banking Alliance is under review as major financial institutions pause climate commitments.

ADB–ITC SME Toolkit launches: Small businesses in Asia Pacific’s textile sector gain a practical roadmap to meet ESG standards and access finance.

BAFT goes global: Now independent from ABA, BAFT pivots to a globally neutral posture.

PayPal faces €10bn disruption in Germany: Payment outages highlight risks of platform concentration.

From Singapore, coming soon on TTP

Carlos Kuriyama (APEC): Supply chain resilience, digital trade frameworks, and cross-border SME finance.

Komgo Treasury Meetup: KPMG’s Benjamin Gayet and others discuss why TMS tools still miss trade finance.

📲 Digital docs and new liquidity: Traydstream’s $11m raise and the broader shift in digital processing.

💼 ICC Banking Commission briefing: Basel, taxonomy, and the evolving role of the ICC Trade Register.

💬 Dr Rebecca Harding: Trade is now a tool of economic warfare—what does this mean for transaction banks?

📉 Risk corridors in a weaponised world: Pangea Risk’s Dr Robert Besseling maps East–West disruption and Global South opportunity.

🔗 Interoperability panel at ITFA: Identity, legal scaffolding, and next steps for connected digital trade.

🤝 SCF deep dive with Merisa Lee Gimpel, Chetan Talwar, and Alex Fenechiu: Can SCF finally reach deeper-tier suppliers in emerging markets?

Until next week,

– Deepesh, Eleanor, Joy, Carter

Table of Contents

Slow read

Factoring and finance in a new trade geography

Trade seems to be fragmenting. The once-tightly integrated supply chains that connected extractor to producer to consumer are fraying under the weight of tariffs, political realignments, and the shifting sands of industrial policy. Economic nationalism is back on the agenda, and global trade flows are being rerouted in response.

Most of the headlines today are focused on the use of weaponised trade policy in the geopolitical posturing currently taking place among global leaders. Behind those headline-grabbing moves are other, more sustained currents that are driving trade and its financing forward.

To really understand what is going on today, one must look beyond the surface and deeper into the regions, technologies, and institutions underpinning it all. For trade finance, historically viewed as a paper-bound sector, some of that change is digital, some legal, and still some contextual.

To explore this in greater depth, Trade Treasury Payments (TTP) Editor Deepesh Patel spoke with Neil Shonhard, CEO of MonetaGo, and Neal Harm, Secretary General of FCI, following the July Breakfast Club in London.

China’s export markets are shifting

Chinese exports are being diverted away from America, and many commentators point to US President Trump’s latest round of trade policies towards its economic rival as the cause of this rerouting.

The beginning of this change, however, predates Trump’s return to the Oval Office.

Harm noted that the trend is tied to broader shifts in trade flows and the growing importance of emerging corridors. “You look at Bangladesh and Cambodia and Vietnam, you look at South America, you look at what’s going on in Africa. These are all corridors that were very well established with the West, but have seen seismic shifts in their trade partners over the past decade,” he said.

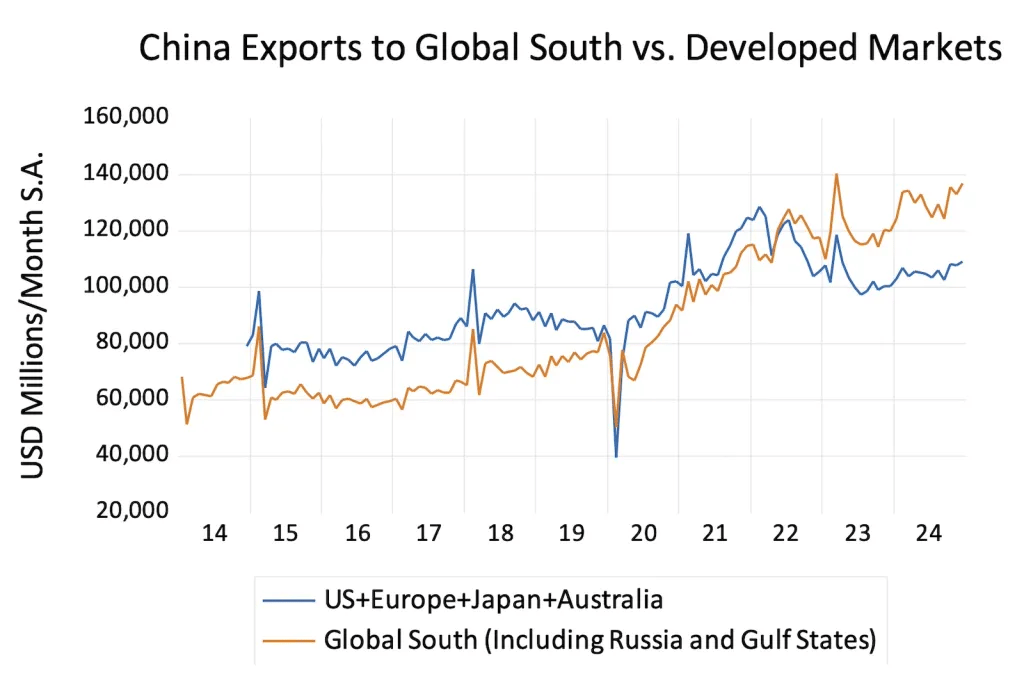

Even in 2023, China’s exports to the developing “Global South” economies surpassed its shipments to all developed markets, as the share going to the United States fell to only about 15% (down from 20% in 2018).

Source: Asia Times

These shifting trade flows are backed by over a decade of strategic infrastructure investments under China’s Belt and Road Initiative, a global infrastructure development strategy first adopted by the country in 2013.

For example, in November 2024, China officially opened a mega-port in Chancay, Peru, its first port in South America and the largest on the west coast of the continent. The deep-water port, financed by over $1 billion in Chinese loans since planning started in 2018, gives China a direct Pacific gateway to resource-rich South America and cuts shipping times to Asia by up to two weeks.

The level of investment in trade infrastructure is paying off. Over the past decade, Beijing has unseated the US as South America’s largest trading partner by aggressively expanding its import purchases from the region (which are generally of commodities like soy, corn, copper, etc.).

China has been able to adapt so quickly to protectionist pressures from the White House because it has been laying the groundwork for revised export flows since well before Trump fired warning shots during his first term in office.

While advancing China’s influence, that physical infrastructure in the global south is also helping promote greater South-South trade connectivity. Digital infrastructure development across that region presents another opportunity.

Trade digest

ITFA’s own mentoring scheme, which has been running since 2016, and the annual competition are blunt acknowledgements that succession cannot be left to chance. BAFT’s Future Leaders programme is pushing in the same direction.

Here were the leaders:

Alena Malgina — Platforms failed; incentives did not

The industry spent years chasing bank backed platforms only to watch them sputter. Alena’s work separates digitisation, which is paper to PDF, from digitalisation, which is redesigning the process so value actually changes. She dissects why several poster children collapsed: heavy governance, slow onboarding, closed loops, and thin end user value.

The record backs her up.

We.trade shut in 2022 after funding dried up. The Marco Polo network entered insolvency in 2023. Contour’s assets were sold to a fintech in early 2024. Technology was not the villain, misaligned incentives were. The next wave looks more like interoperable rails supplied by nimble vendors, not member only clubs.

Aziz Kakhkharov — Turning dilution from a black box into a pricing signal

Factoring is big, steady, and often overlooked. Global volumes grew again in 2023, with the industry hovering in the multi trillion range. Yet one of its costliest leaks (dilution) remains badly managed. Dilution is not default, it is the drag from returns, credit notes, discounts, and disputes that erode invoice face value. Today’s blunt fix, flat reserves, ties up capital and fogs pricing.

Aziz’s project proposes a switch to dynamic models that segment debtors by behaviour and adjust advance rates and fees in near real time.

Sanjana Gulwaney — Making sustainability bankable for SMEs

The most overtly developmental entry reframes the trade finance gap through a climate lens. The proposal is a blended finance guarantee providing up to 80 percent risk coverage for loans to green SMEs via donor first loss capital, starting with a pilot in Bangladesh. The SME base is vast and climate shocks are a balance sheet reality. The macro context is stubborn. The global trade finance gap hit 2.5 trillion dollars in 2022. Bangladesh alone counts millions of SMEs and faces recurring cyclone linked losses in the billions annually according to World Bank analysis. The aim of the project is turn climate intent into bankable credit by de risking the first mile.

#TTPulse: The ITFA DNI standard is now integrated into the ICC DSI’s KTDDE

🔸💐 Partnerships in play: A successful marriage?

What does this mean?

📅 In 2018, ITFA created the Digital Negotiable Instruments (DNI) standard, an initiative aimed to enable the use of the electronic Bills of Exchange and Promissory Notes.

However, this standard could only be used by its members.

The International Chamber of Commerce's Digital Standards Initiative (ICC DSI) proposed to integrate the DNI standard as the industry standard under the Key Trade Documents and Data Elements (KTDDE).

➡️ Today, this alignment is now complete. We'll be releasing this fireside chat with Trade Treasury Payments (TTP) Global Advisory Panel member and ITFA Board Member (Head of the Fintech Committee), André Casterman, and TTP Editorial Board Member and Managing Director of ICC DSI, Pamela Mar.

Treasury and Payments Digest

The partnership, announced on 4th September 2025, brings together institutional banking expertise with modern treasury technology.

HSBC Innovation Banking UK, a subsidiary of the global financial giant focused on serving technology and innovation-driven sectors, has integrated its global banking infrastructure with Atlar’s treasury platform. This integration creates a comprehensive solution that provides real-time visibility, better control over treasury, and automated workflows for finance departments dealing with the complexities of multi-entity, cross-border operations.

Real-Time API integration speeds up treasury operations

A key feature driving this partnership is the direct API integration between HSBC’s banking services and the Atlar platform. This allows customers to link their accounts in minutes, making onboarding much faster and treasury management more efficient.

The implementation provides key benefits such as faster setup and onboarding, no need for IT support or technical skills, real-time reporting of bank balances and transactions via secure API connections and a tested API connection for speed and reliability.

For finance teams at growing companies, these improvements eliminate many time-consuming manual processes and reconciliations, while providing real-time visibility on cash flow.

Joel Nordström, Co-founder and CEO at Atlar stated, “This collaboration brings together the best of both worlds: HSBC Innovation Banking’s global banking capabilities and Atlar’s modern treasury technology. Together, we’re helping fast-scaling companies automate manual processes and gain the visibility they need to scale with confidence.”

#TTPulse: BAFT's new chapter: Association becomes independent entity for global banking

🔸The BAFT (Bankers Association for Finance and Trade) has formally announced its independence from the American Bankers Association (ABA), marking a strategic move to enhance its global impact.

🔸Founded in 1921 by 10 midwestern U.S. bankers, BAFT is now stepping into a new era as the leading global industry association for international transaction banking with members in over 60 countries.

🔸The independence enables BAFT to maintain geopolitical neutrality and better represent the diverse interests of its international membership, particularly important as over 70% of BAFT's member banks are headquartered outside the United States.

🔸BAFT's mission continues to focus on providing thought leadership, advocacy, education, and a platform for collaboration to promote sound financial practices in transaction banking.

🔸The organisation operates five regional councils supporting the global transaction banking community, with a focus on areas such as trade finance, payments, and compliance to help members navigate a rapidly evolving global landscape.

#TTPulse: PayPal resolves €10 billion German payment disruption after banks freeze transactions

🔸PayPal has confirmed the resolution of a widespread payment disruption in Germany that prompted local banks to freeze more than €10 billion ($11.7 billion) in transactions over security concerns.

🔸The disruption erupted on August 27 when German lenders, including DZ BANK AG and Bayerische Landesbank, identified millions of suspicious direct debits linked to PayPal's payment processing system.

🔸Germany's Savings Banks and Giro Association, representing more than 300 institutions, confirmed that unauthorised transactions had caused widespread disruption to payments across Europe, particularly in Germany.

🔸According to reports in Sueddeutsche Zeitung, PayPal's security system, normally used to vet transactions for fraud, had stopped functioning, resulting in unverified debits being sent through the system.

🔸The incident has drawn attention in Germany to the risks of relying heavily on a single U.S. company for online payments, with the German finance ministry highlighting the need for resilient payment infrastructure.

🗓️ Upcoming events

Featured events by TTP

Partner events

Digital Trade Transformation Forum

| ICISA Trade Credit Insurance Week 2025

|

BAFT Virtual Trade Finance Workshop

| WTO Public Forum

|

SME Finance Forum

| BAFT Global Councils Forum

|

Sibos

| TTP Boat Cruise at Sibos

|

16th CEE & SEE Regional Conference on Factoring & SCF

| ICC Supply Chain Finance Summit

|

Feleban

| Trade Finance Investor Day

|

Multimedia from Trade Treasury Payments

Videos

Reels

🏆 GAP of the Week: Alexander Malaket, Prism Partners

Global Advisory Panel member Alexander Malaket spoke to TTP in Singapore last week.

🌟 Daily Mission:

Drive impact and contribution through trade and trade financing, globally.

Stay in learning mode, maintain a spiritual dimension and enjoy a life well lived.

Explore - ideas, cultures, countries and cuisines - connect meaningfully.

🤳 Behind the scenes:

Exactly!! That's how I like to operate... :)

🪷 Life Mantras:

Ideas are like networks: more powerful when shared - thoughtfully.

It's always interesting and enriching to find the "unique angle or perspective", and that unique angle often shows up at the intersection of disciplines.

📋 Hidden facts:

Richness comes in many forms - the variety in travel, languages and cultures, the joy of a Michelin-Star dinner or the perfection of a "vegetarian" soup that is boiled water with one salad leaf in a hole-in-the wall somewhere on the map; hitting the highway at speed with the purr of the engine and a hot Latin beat coming together; the flow of a perfect "three-step sparring" session with a more advanced practitioner; the peace and flow of a swim in a rough-ish ocean; a stunning sunset over the Gulf in RAK, or a breathtaking view in a paraglider over the Himalayas.

The silent connection that needs no words or explanation.

The Hidden Fact: It's never too late to learn to balance life!

Did You Know? Asia Pacific is still the world’s economic growth engine — led by Viet Nam, the Philippines, Cambodia, Mongolia, and Uzbekistan, with ADB projecting 4.8% growth in 2025–26.

Till next time,