- Trade Treasury Payments | The Liquidity Brief

- Posts

- TTP | Issue 03

TTP | Issue 03

Curb your Monday blues with our liquidity brief. The only newsletter in liquidity and risk management that you need to subscribe to. For the hustler, the CEO, the intern, the MD. Prepare for your week ahead, with the biggest voices, heavyweight leaders, and the meaningful conversations in trade, treasury, and payments. No spin, no bias, no gatekeeping—just honest, high-value insights.

Skip to your favourite part

🌟 Editor's note

Last week, we celebrated the official launch of Trade Treasury Payments (TTP) at the House of Lords, sponsored by Lord Davies of Gower Byron. Over 100 industry leaders supported the launch, and we proudly launched our Global Advisory Panel (GAP), a panel of either geographically spread, or sector specific experts, to help ensure our coverage is comprehensive and relevant. The event, which debated the role of truly independent media was followed by our ‘Open House’ in Brick Lane London, where we opened our offices to the industry to take part in interviews and podcasts, meet the editorial team, and discuss the topics most important to them to help shape our future editorial agenda.

We are spreading ourselves thin this week, as trade, treasury, and payments kicks off all around the world.

All eyes on BAFT GAM

Our trade and technology editor Carter Hoffman will be across the pond in Washington DC, interviewing and reporting from BAFT’s Global Annual Meeting, joined by several from our Global Advisory Committee, including Duarte Pedreira, Patrik Zekkar, Gerardo Guituirex. If you’re about, please do introduce yourself and pick up a hard copy of our inaugural magazine, which, at the time of writing, is currently in the hold of a B777 somewhere in the mid Atlantic. Find out more here.

Payments hits Canada

The 2025 Payments Canada SUMMIT will gather nearly 2000 professionals in payments. will be descending on Toronto. Key themes include payments modernisation, politics and payments, and the ISO 200022 transition. TTP’s Carter Hoffman will be reporting from this event. Find out more here.

Meanwhile… in Doha…

This week, MERGE is spearheading the inaugural Qatar Trade and Treasury Transformation Summit 2025 alongside Qatar Chamber and ICC Qatar. This event promises to be a cornerstone for digital transformation discussions in the transaction banking space, aiming to empower corporate treasury teams with advanced solutions. There are plans already for the 2026 edition to include a dedicated FinTech expo as part of the summit. Treasury editor Eleanor Hill, as Content Director of MERGE Events, will be there to discuss the latest trends and critical market insights. Find out more here.

Commodity Trading Week Europe descends on London

Love commodities? We do too. This week, industry experts will be at London’s Commodities Trading Week Europe. I will be moderating panels with Jonathan Sims, Vashti Maharaj, Dhaval Shah, Ilya Medvedenko and James Lowrey, covering both sustainable trade finance 2.0, and the impact of the latest wave of Basel announcements and its implications on structured commodity trade finance. Find out more here. Global Advisory Panel’s Chris Southworth is also a keynote speaker. Find out more here.

PAPPED: Top pics from the TTP launch reception

|  |

|  |

|  |

Slow read

My first exposure to a major currency was when the EURO came into being in 1999. Still new to the FI world, we sold EUR nostro accounts to banks in the India Subcontinent in those days. Folks were reluctant to see the advantage, but slowly saw the light, and the French Franc and the Deutsche Mark slowly faded into oblivion.

My exposure to RMB began around 2012 or so. I remember a presentation we made to the financial institutions in Bangladesh, firstly by explaining that the RMB or Yuan was the same as CNY or Renminbi. That was confusing enough for me when we got started and then CNH came to be.

The bank that I worked for was a foreign member of CIPS and tasked with internationalising the RMB. We spoke about invoicing imports and exports to China in RMB. The bank officials were very nice and listened to the pitch. Then Q and A started, and one gentleman very politely asked, “But sir, we never invoice in RMB or Yuan, so why bother?” That was a decade or so ago. Today, 22% of Bangladesh Trade is with China, a substantial part, I believe, in RMB, which is now a currency the central bank allows accounts to be opened in.

A decade was all it took

The RMB trade has grown substantially since then, with trading in over 12 offshore centres like Singapore and London. Admittedly, a large part of this is in HK – close to 80%, with the UK and Singapore making up about another 10%. But it is also cleared in the US with over 2%!

Source – SWIFT RMB tracker SWIFT

Over the years, China has been very creative in ensuring RMB use, including figuring out that regulations in Hong Kong could help – thus the CNH (H – for Hong Kong) as opposed to CNY. That was a masterstroke in my mind as it got importers and exporters comfortable with the currency without the extra regulatory framework.

So, where are we today?

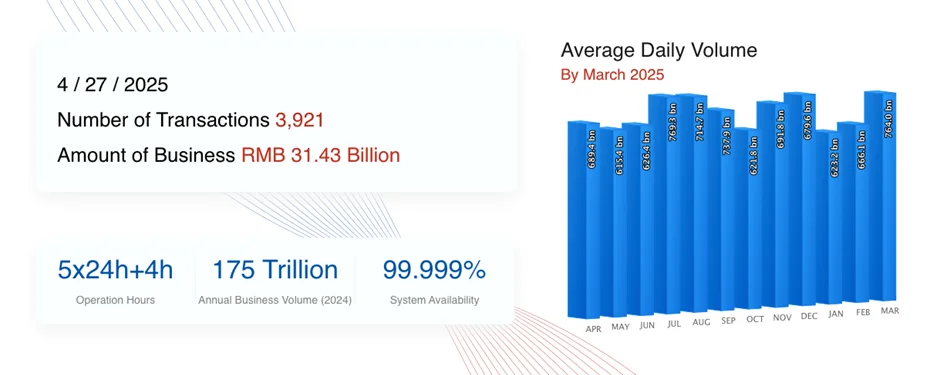

We have been hearing anecdotal mentions of Russia and Iran dealing in RMB since they cannot connect to SWIFT (none in Iran, some in Russia). The clearing system in China, the Cross-border International Payment System (CIPS), with 36 domestic and overseas financial institutions as shareholders, has seen growth in volumes, as is evident from the chart below.

Linked to this is what SWIFT data from their RMB tracker shows us. RMB is the second largest currency for trade, superseding the EUR in January 2025 and now ahead by over 15% at over 7.38%.

Trade digest

Treasury digest

Payments digest

🗓️ Upcoming events

BAFT Financial Crime Compliance Workshop TTP’s official launch reception. We’re gathering over 100 leaders across trade, treasury, and payments to see our vision and share our launch celebration.

| BAFT Global Annual Meeting Three days of insights from leading voices in banking, compliance, trade, and payments. TTP’s Carter Hoffman will be attending. Grab a coffee with him here.

|

The 2025 Payments Canada SUMMIT ‘Innovate. Collaborate. Transform.’ exploring the future of payments globally and in Canada. TTP’s Carter Hoffman will be attending. Grab a coffee with him here.

| Commodity Trading Week Europe Explore the intricate details and evolving complexities of the commodity trading landscape. TTP’s Deepesh Patel will be speaking.

|

2025 EBRD TFP Information Session and Awards Ceremony TTP’s Deepesh Patel will be speaking at the EBRD Trade Facilitation Programme Information Session and Awards Ceremony.

| ICC DSI x TTP Tradetech Roundtable Join ICC Digital Standards Initiative’s Managing Director at a Tradetech leaders roundtable in London.

|

Multimedia from Trade Treasury Payments

Latest podcast

To learn more about how financial institutions globally assess and improve their accessibility across employment, culture, product access and partnerships, Trade Treasury Payments (TTP) Editor Deepesh Patel spoke with Maka Bochorishvili, Environmental, Social and Governance Coordinator at TBC Bank; Mirza Muhammad Asim Baig, Senior Executive Vice President & Group Chief - Human Resource Management Group at National Bank of Pakistan; and Catherine Holloway, Co-founder & Academic Director of the Global Disability Innovation Hub (GDI Hub) and a Professor at University College London.

🚀 TTP report: Launching this week

As our world becomes increasingly digital, the digital divide has widespread implications, and the least developed countries (LDCs) are most likely to be negatively affected¹. In addition to the three levels of the digital divide commonly explored in the literature (i.e. the access gap, differences in digital skills, and differences in beneficial outcomes), data inequality should be included as a new level of the digital divide². Data inequality can further be classified into three divides: access to data, representation of the world as data, and control over data flow.

With these divides as the primary markers for data inequality and using international trade and investment as guideposts for economic development, this report aims to highlight the potential implications that digital advancements in the international trade industry will have in terms of widening data inequality. Given that the least developed countries are most impacted by data inequality and that there is a positive relationship between data availability and international trade and investment, data inequality can exacerbate economic inequality as international trade becomes more digitalised.

Out this week on TTP. Watch out.

🦄 Company spotlight

MERGE — A pioneering events and thought leadership provider in the international trade, treasury, credit, commodities and payments arena.

MERGE is dedicated to creating exceptional content, networking, and educational experiences for professionals in the international trade, treasury, credit, commodities and payment arena.

The primary goal at MERGE is to connect industry professionals by gathering all key stakeholders in this ecosystem to learn, network, and exchange ideas and opportunities.

MERGE curates content programmes to cover a wide range of topics relating to international trade. This is ideal for exporters/importers who are looking to improve their financial capabilities through accessing thought leadership, and expand their global business opportunities. It also provides an essential forum for government officials, banks, alternative financiers, policy makers, regulators, fintech companies, trade credit insurers, legal firms, consultants, and professionals engaged in global trade.

Queenie Taylor-Wong, Co-Founder & CEO emphasizes the value in working collaboratively: "The power of connections should never be underestimated - whether you're an established business leader or the founder of an early-stage start-up. Bringing people together and establishing impactful relationships is the ultimate trading currency."

🏆 Reader of the week

| Katie Gates, DNB🌻Daily Mission: Turn coffee into joy (and occasionally share with deserving humans) Collect passport stamps, book quotes, and animal friends Brighten days - intentionally or "accidentally" Superpowers: Espresso Alchemy (Transforms beans into liquid motivation + occasional nervous energy) Multidimensional Learning (Currently absorbing irrelevant knowledge via geeky podcasts - the more obscure the fact, the better Animal Whispering Behind the Scenes: Secretly practices piano with the drama of a concert hall soloist Known to laugh until i cry, then laugh about crying Life Mantras: “Never stop being that person who gets excited about l learning” “A day without laughter is like coffee without caffeine - why even bother?" “The world needs more enthusiasm, more wagging tails, and better playlists" |

Did You Know? More than 4,000 years before blockchain, ancient Sumerian traders used cuneiform tablets to record contracts, inventories, and transactions — laying the groundwork for today’s digital trade ledgers and smart contracts.

Till next time,