- Trade Treasury Payments | The Liquidity Brief

- Posts

- TTP | Issue 04

TTP | Issue 04

Curb your Monday blues with our liquidity brief. The only newsletter in liquidity and risk management that you need to subscribe to. For the hustler, the CEO, the intern, the MD. Prepare for your week ahead, with the biggest voices, heavyweight leaders, and the meaningful conversations in trade, treasury, and payments. No spin, no bias, no gatekeeping—just honest, high-value insights.

Skip to your favourite part

🌟 Editor's note

Good evening, Europe! (IYKYK)

If this week is anything to go by, trade and treasury are no longer backroom topics—our mums, dads, daughters and sons are taking (a bit of) interest too! The TTP team has been ‘liquid’, deployed across continents, from Qatar to Washington to Toronto and back to London, reporting on B2B, B2C, B2G, B2B2C.

At the Asian Development Bank’s (ADB) 58th Annual Meeting in Milan, the focus was squarely on climate resilience and sustainable development. President Masatsugu Asakawa emphasized the urgency of addressing climate change, debt burdens, and digital divides, advocating for bold collective action to tackle these complex challenges.

Probably overshadowed by various diplomatic heats between Canadian, US and UK politicians, BAFT’s Global Annual Meeting in Washington D.C. and Payments Canada’s headline sessions in Toronto pointed to a structural rethink in cross-border payments and trade. Whether it’s AI reshaping compliance or infrastructure investments catching up with innovation, the message was clear: agility and interoperability are no longer optional. Our editors engaged directly with banking leaders, from Banorte to Wells Fargo, to unpack how institutions are financing newly formed trade corridors.

The UK’s trade diplomacy also made headlines this week, with two historic deals landing within days. A £25.5bn UK–India free trade agreement slashes tariffs on whisky, cars, and textiles, unlocking long-term market access for key British industries. Not to be outdone, a UK–US tariff accord — the first of its kind since Brexit — reinstates predictability for transatlantic exporters, with immediate wins for the auto and steel sectors. But the deals also carry deeper implications: liquidity planning, tariff hedging, and renewed complexity in risk pricing for corporates and financiers alike.

From sustainable commodities to the geopolitics of digital trade, our coverage this week features some sobering trade finance gaps in Mexico, Honduras and Guatemala, and also features Afreximbank’s bold $1bn Africa Film Fund, a wave of private sector innovation.

As we look ahead, all eyes are on 13 May, with the EBRD’s Trade Facilitation Programme Awards, our joint roundtable with ICC DSI on digital trade adoption, and a morning session with ITFA and FCI on trade innovation. Next stop: Basel (not III, or IV capital relief) — which will soon take centre stage as the host city for this year’s Eurovision Song Contest. (So if news slows towards the end of the week, you’ll know why!)

Until then, ciao for now!

— The Editors

Trade Treasury Payments (TTP)

Slow read

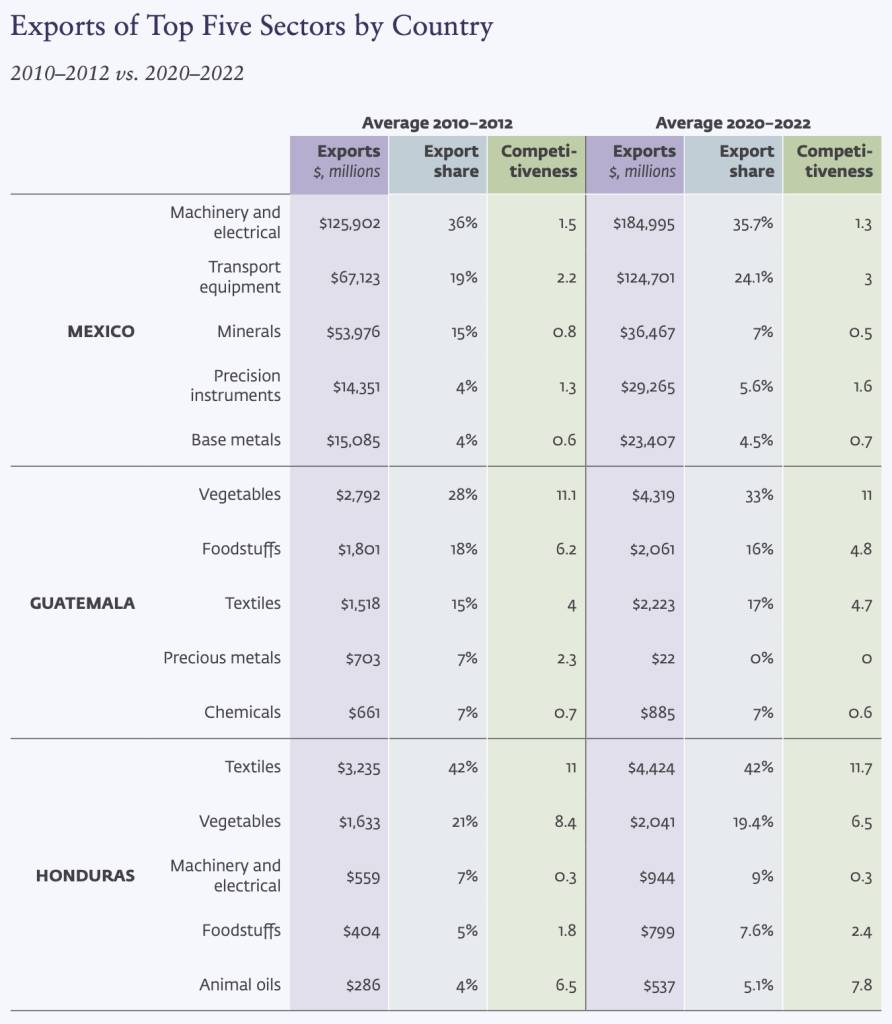

At a glance, the trade dynamics of Guatemala, Honduras, and Mexico, the so-called CAM-3, present a story of modest but consistent economic ascent. Mexico has strengthened its status as a high-value manufacturing hub, while Guatemala and Honduras have diversified their exports in agriculture and light manufacturing.

Table: Sectoral Export Growth in CAM-3

But beneath the surface, a shortfall persists: trade and supply chain finance. In these three countries, access to reliable, affordable trade and supply chain finance remains the exception rather than the norm.

The International Finance Corporation (IFC) and World Trade Organization (WTO) launched their latest joint report, Trade Finance in Central America and Mexico, at an event hosted by the Instituto Tecnológico Autónomo de México (ITAM) in Mexico City on 29 April 2025.

The study, which focuses on Guatemala, Honduras and Mexico, reveals that despite steady trade growth and increasing export diversification, access to trade and supply chain finance remains limited—covering as little as 8–12% of merchandise trade across the three countries.

The report warns that this persistent financing gap is constraining the region’s trade potential, especially for smaller firms and non-related-party exporters, and estimates that improved access to affordable trade finance could unlock over $90 billion in additional trade annually across the CAM-3.

While access to capital is becoming more efficient globally, trade finance in the CAM-3 remains constrained. According to IFC-WTO data, only 8% of Mexico’s merchandise trade is backed by trade or supply chain finance (TSCF). For Honduras and Guatemala, the figures are slightly higher—10% and 12% respectively—but still lag considerably behind benchmarks in Asia and West Africa.

This is not for lack of trade. Mexico alone has seen its exports to the United States grow by over 30% in a decade, buoyed by its increasingly sophisticated manufacturing base. Meanwhile, Guatemala and Honduras are exporting more food, textiles, and industrial inputs across Latin America. The report highlights that the disconnect lies between the rising complexity of these economies and the maturity of their financial infrastructure.

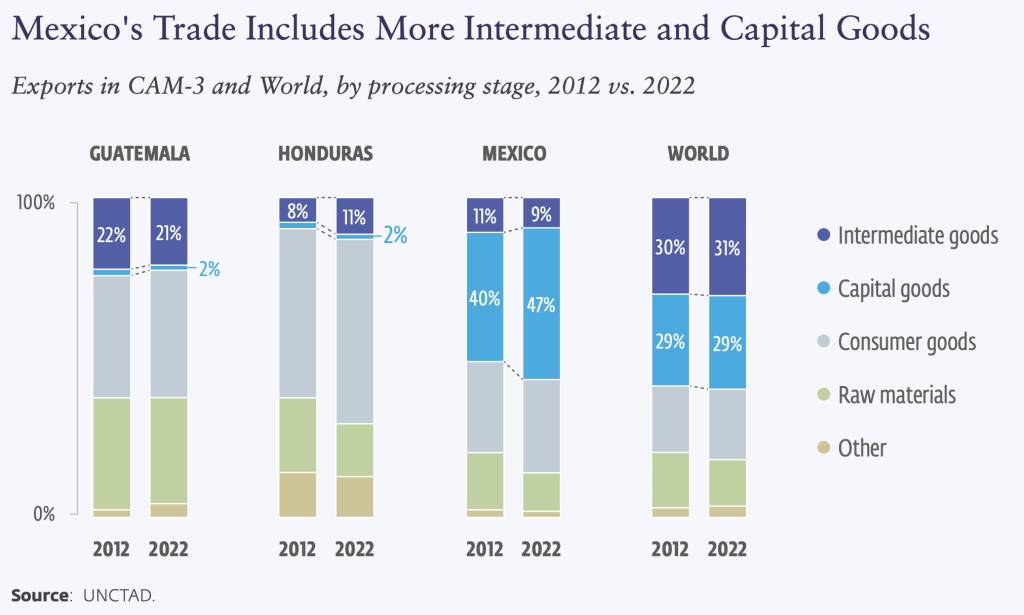

Figure: Export Composition by Processing Stage

Much of the region’s trade continues to operate on open account terms, which favour buyers and provide limited protection to sellers. Letters of credit and other traditional risk-mitigating tools are used sparingly. Supply chain finance accounts for only 1% of total trade in Mexico, and even less in its neighbours.

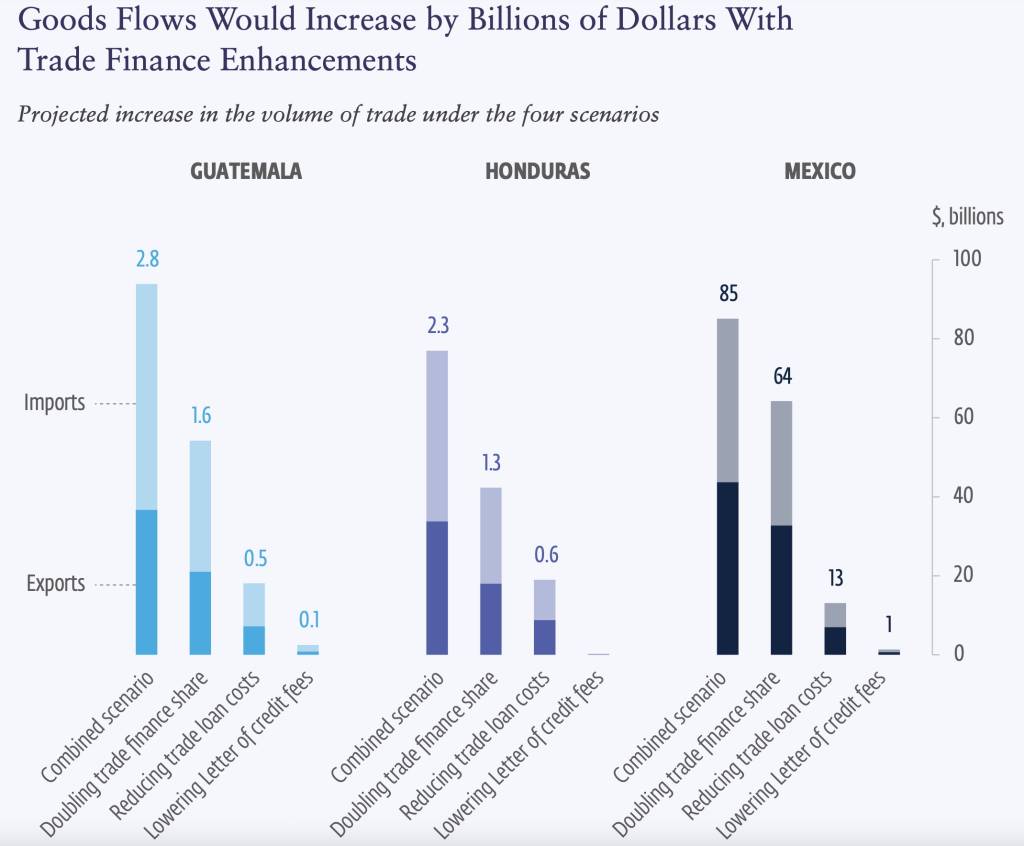

The $90bn export opportunity

The IFC-WTO model suggests that closing the trade finance gap could be transformative. Doubling TSCF coverage and aligning financing costs with international norms could increase Mexico’s exports by 7.4% annually—an $85 billion gain. For Guatemala and Honduras, export volumes could grow by nearly 8% each, equivalent to $2.8 billion and $2.3 billion respectively.

Critically, these gains would be concentrated in sectors where the region has a competitive edge: textiles and agriculture in Central America; automotive and electronics in Mexico. Imports would rise in parallel, driven by increased access to intermediate and capital goods—fuel for the manufacturing engine.

Figure: Trade Potential from Closing the TSCF Gap

Trade digest

Treasury digest

Payments digest

🗓️ Upcoming events

2025 EBRD TFP Information Session and Awards Ceremony TTP’s Deepesh Patel will be speaking at the EBRD Trade Facilitation Programme Information Session and Awards Ceremony.

| ICC DSI x TTP Tradetech Roundtable Join ICC Digital Standards Initiative’s Managing Director at a Tradetech leaders roundtable in London.

|

Transforming trade finance An ITFA/FCI/EBRD morning event covering the latest trends in trade finance, discussing funding solutions and innovative tools shaping the future of the industry.

| Eurovision Song Contest A spectacular international gathering bringing together performers, fans, and broadcasters from over 35 countries — celebrating music, creativity, and cultural connection live on stage and across millions of screens.

|

ICC Austria’s Trade Finance Week An educational and networking event bringing together 400+ participants from 35+ countries, discussing the latest in Letters of Credit and Bank Guarantees.

| RFIx25 Hosted by BCR, the 2025 Receivables Finance International (RFIx25) marks its 25th anniversary, bringing together key industry players from across the world for two days of thought leadership, strategic discussions, and high-level networking in London.

|

Money 20/20 Some of the TTP editorial team will travel to find out the latest in cross-border B2B payments, at Money 20/20 Europe.

|

Multimedia from Trade Treasury Payments

Latest podcast

To learn more about how financial institutions globally assess and improve their accessibility across employment, culture, product access and partnerships, Trade Treasury Payments (TTP) Editor Deepesh Patel spoke with Maka Bochorishvili, Environmental, Social and Governance Coordinator at TBC Bank; Mirza Muhammad Asim Baig, Senior Executive Vice President & Group Chief - Human Resource Management Group at National Bank of Pakistan; and Catherine Holloway, Co-founder & Academic Director of the Global Disability Innovation Hub (GDI Hub) and a Professor at University College London.

🚀 TTP report: Now launched!

As our world becomes increasingly digital, the digital divide has widespread implications, and the least developed countries (LDCs) are most likely to be negatively affected¹. In addition to the three levels of the digital divide commonly explored in the literature (i.e. the access gap, differences in digital skills, and differences in beneficial outcomes), data inequality should be included as a new level of the digital divide². Data inequality can further be classified into three divides: access to data, representation of the world as data, and control over data flow.

Highlights from this edition:

🏆 Welcoming our newest editorial board member: Catherine Lang Anderson!

We welcome Catherine to TTP’s editorial board. A partner at law firm A&O Shearman, Catherine acts for a variety of clients across the full range of trade, commodities and supply chain products, including prepayment facilities, structured commodity finance, trade receivables and supply chain finance and restructurings in the commodities sector.

Catherine is an advocate for gender, diversity and representation across the trade, treasury and payments industry, a leading voice for TTP’s Women in Trade, Treasury & Payments initiatives.

Fun fact: Sometimes seen performing in London musicals, Catherine plays the viola. Watch out West End!

Meet the Global Advisory Panel (GAP): Fatenah Danab

Strong women lift each other… and also dumbbells.

Fatenah Danab, Head of Trade and Working Capital, Middle East, Barclays. TTP Global Advisory Panel: Middle East & North Africa | 🏋️♀️ Daily mission:

☕️ Behind the scenes:

✅ Life mantras:

⚡️ Hidden facts:

|

Did You Know? ABBA’s Eurovision win in 1974 turned them into a $2 billion export. Sweden’s most famous musical export won Eurovision with “Waterloo” — and went on to become one of the highest-selling music acts of all time. Sweden’s music industry is now worth over €1.5 billion annually.

Till next time,