- Trade Treasury Payments | The Liquidity Brief

- Posts

- TTP | Issue 05

TTP | Issue 05

Curb your Monday blues with our liquidity brief. The only newsletter in liquidity and risk management that you need to subscribe to. For the hustler, the CEO, the intern, the MD. Prepare for your week ahead, with the biggest voices, heavyweight leaders, and the meaningful conversations in trade, treasury, and payments. No spin, no bias, no gatekeeping—just honest, high-value insights.

Skip to your favourite part

🌟 Editor's note

This week, the world’s trade, treasury, and payments infrastructure went into overdrive. Geopolitics, liquidity crunches, and digitisation milestones all unfolded simultaneously. The TTP editorial team kept pace across boardrooms, broadcast studios, and breakout sessions, capturing the latest real-time shifts from emerging markets to multilateral bank corridors.

In London, the EBRD’s Trade Facilitation Programme Awards and Annual Meeting brought trade finance back into the spotlight. Our editors were on the ground, moderating discussions on digital adoption, regional risk, and liquidity resilience — and speaking with voices from Taiwan, CaixaBank, and Quds Bank about ESG, MLT, and untied financing. EBRD’s latest Regional Economic Prospects report warned of “uncertain times” ahead: sluggish growth, resurgent tariffs, and rising geopolitical stress testing the fabric of global commerce.

At the same time, our joint digital trade roundtable with ICC Digital Standards Initiative surfaced one common pain point: fragmentation. Whether you’re a fintech, bank, or policymaker, scaling digital trade requires more than frameworks — it demands radical collaboration, legal alignment, and regional capacity building.

And speaking of scale, the Digital Container Shipping Association (DCSA) completed its first interoperable electronic Bill of Lading transaction, proving that cross-platform eBLs can, in fact, move pulp across oceans and possibly push digitisation past its tipping point.

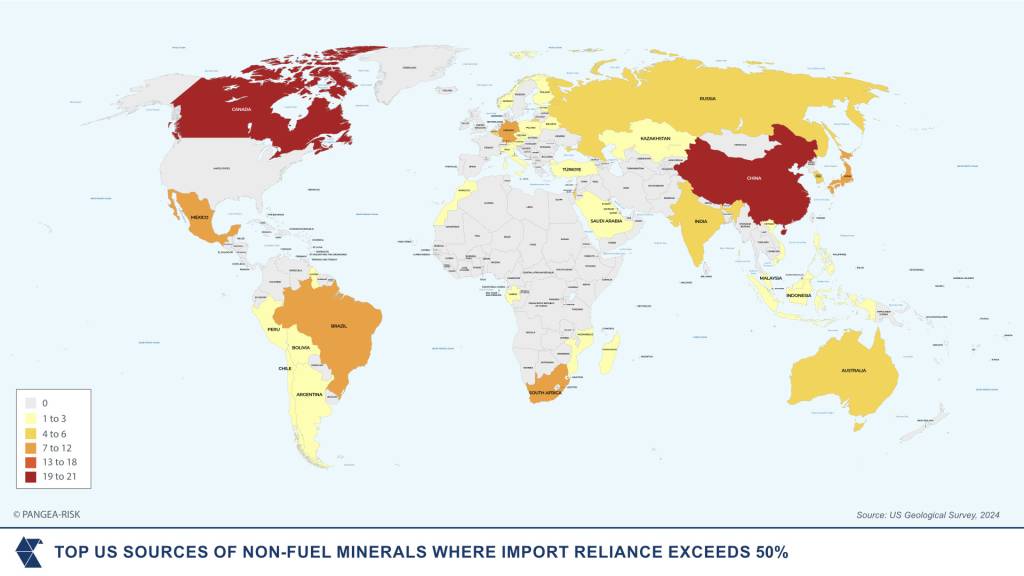

Meanwhile, mineral diplomacy is turning transactional. Our special report, thanks to our new partnership with Pangea Risk, unpacks how US policy under President Trump is shifting from multilateralism to minerals-for-security swaps, with Africa, the Gulf, and even Greenland caught in the crossfire. Pangea-Risk’s analysis reveals how resource-rich states are asserting leverage, which is both an opportunity and creates volatility for financiers and exporters.

In the US, Moody’s finally pulled the trigger, downgrading America’s credit rating to Aa1. The rationale? Worsening debt affordability. With only nine countries left in the coveted AAA club, questions loom large over global capital flows, dollar dominance, and liquidity strategies.

And for treasurers caught in the crossfire, Eleanor’s latest article unpacks how FX strategies are being stretched, automated, and rethought entirely as tariff-driven volatility forces a rethink of the “dollar default.”

As if that weren’t enough, Chinese cargo ships have all but disappeared from California’s ports following sweeping US tariffs — a maritime blackout not seen since the early pandemic. Supply chain resilience is no longer just a buzzword; it’s a boardroom priority.

And in the world of treasury and payments, FX volatility and tariff hedging are front-of-mind. From Barclays’ AI-powered risk partnership with Ant International to our explainer on stablecoins and MiCA, the convergence of finance and technology continues to accelerate.

🎤 Don’t miss: Our livestream this week on Tuesday, featuring TTP Global Advisory Panel member George Riddell — Tariffs, treasury, and trade finance — featured a frank conversation with experts from Aurora Macro, Goyder Ltd, and ArentFox Schiff.

This week, the team will travel to Vienna, Stockholm and London to cover ICC Austria’s Trade Finance Week, Treasury 360° Nordic 2025, and RFIx25.

Until then, keep it liquid.

— The Editors

Last week in photos

|  |  |

|  |  |

|  |

Slow read

Under US President Donald Trump’s administration, critical minerals have become tools of transactional diplomacy, with bilateral deals tied to security, access, and political alignment, exemplified by proposed agreements with Ukraine and the DRC. The US is increasingly relying on Gulf states to close financing and processing gaps in its mineral strategy, with the UAE and Saudi Arabia expanding their roles in the global supply chain. Resource-rich governments in Africa and beyond are leveraging heightened demand to renegotiate terms, assert control over exports, and extract greater economic and political value.

Since United States (US) President Donald Trump was inaugurated in January, a series of executive and foreign policy actions have placed his objective of “restoring America’s mineral dominance” at the centre of the new administration’s agenda. These include efforts to compel Ukraine to grant access to its mineral and energy assets as a condition for continued US support in the war against Russia, and renewed interest in securing control over mineral resources in Greenland. The administration has also issued executive orders seeking to expand domestic mineral production and processing, eroding due diligence requirements in the financing of foreign mining projects, and suspending anti-bribery provisions to secure what it terms “strategic business advantages” in the international minerals market.

For African mineral-producing countries, the evolving global political environment introduces both elevated risks and prospects of enhanced leverage. Whereas competition over mineral access has traditionally been shaped by intersecting economic and national interests, the present posture of the US government reflects a more explicitly transactional orientation. Several African governments are already adapting to this recalibrated environment. Amid an ongoing offensive by M23 insurgents in its eastern provinces, the government of the Democratic Republic of the Congo (DRC) has explored an arrangement with the US involving the exchange of mineral access for security assistance.

PANGEA-RISK assesses President Trump’s mineral diplomacy, Gulf state integration into US supply chain strategy, Africa’s evolving bargaining power, and rising state control over mineral production.

Trade digest

Treasury digest

Payments digest

🗓️ Upcoming events

ICC Austria’s Trade Finance Week An educational and networking event bringing together 400+ participants from 35+ countries, discussing the latest in Letters of Credit and Bank Guarantees.

| RFIx25 Hosted by BCR, the 2025 Receivables Finance International (RFIx25) marks its 25th anniversary, bringing together key industry players from across the world for two days of thought leadership, strategic discussions, and high-level networking in London.

|

Money 20/20 Some of the TTP editorial team will travel to find out the latest in cross-border B2B payments, at Money 20/20 Europe.

|

Multimedia from Trade Treasury Payments

Latest podcast | The deepfake dilemma: AI, fraud, and the future of finance

Fraud, cybersecurity, and artificial intelligence have long been treated as separate domains within financial services. Each came with its own tools, teams, and terminology, but the walls between them have started to crack.

What once seemed like parallel conversations are now colliding, and the implications are profound. Financial institutions, already under pressure to keep up with digital change, are finding themselves caught between innovation and risk, trust and uncertainty.

To help unpack what this shift means for banks, regulators, and compliance teams today, Trade Treasury Payments’ (TTP) Carter Hoffman spoke with Deepa Sinha, SVP, Payments and Financial Crimes at BAFT and Elizabeth Rosenberg from the Wolfsberg Group.

🏆 Don’t miss out on our broadcast this week: Tariffs, treasury and trade finance

TTP’s Editor-in-Chief, Deepesh Patel, hosts a 30-minute livestream featuring Dmitry Grozoubinski (Aurora Macro Strategies), George Riddell (Goyder Ltd), and Leah N. Scarpelli (ArentFox Schiff LLP) to unpack the pressures reshaping global trade — from resurgent tariffs to treasury turmoil.

As the US pivots to a more protectionist posture, imposing sweeping reciprocal tariffs and disrupting traditional trade routes, the broadcast explores how financial institutions and corporates are adjusting liquidity, risk, and sourcing strategies in real time.

The conversation covers the convergence of trade and monetary policy — from FX volatility and interest rate divergence to the financing strain on exporters. With global supply chains fragmenting, and climate-linked regulations like CBAM adding complexity, the panel offers tactical insights into managing working capital, adapting trade finance instruments, and embracing digital tools to stay resilient.

Streaming live Tuesday, 20 May 2025.

Watch on live on LinkedIn.

Did You Know? In 2024 alone, China invested $21.4 billion into overseas mining projects under the Belt and Road Initiative. By contrast, the US International Development Finance Corporation — the primary vehicle for America’s critical minerals push — had committed just $270 million in total mining investments as of late 2023. That’s a 79x gap, underscoring just how far US-backed initiatives lag behind in the global race for resource security. For mineral-rich nations, the question is no longer who’s interested, but who’s willing to fund, build, and process at scale.

Till next time,