- Trade Treasury Payments | The Liquidity Brief

- Posts

- TTP | Issue 06

TTP | Issue 06

Curb your Monday blues with our liquidity brief. The only newsletter in liquidity and risk management that you need to subscribe to. For the hustler, the CEO, the intern, the MD. Prepare for your week ahead, with the biggest voices, heavyweight leaders, and the meaningful conversations in trade, treasury, and payments. No spin, no bias, no gatekeeping—just honest, high-value insights.

🌟 Editor's note

Editor’s Note | Week of 27 May 2025

This week, the hamster wheel for global trade, treasury, and payments machine kept spinning, and the signal was loud: cross-border modernisation isn’t optional, it’s existential. From Washington to Dhaka, Riyadh to Rio, financial institutions and policymakers continue progress to upgrade legacy rails, plug liquidity gaps, and get serious about interoperability.

Recapping the Payments Summit in Toronto, the “cross-border problem” took centre stage. Industry veterans didn’t mince their words: “The most reliable way to send $5,000 globally in 24 hours? A suitcase, an AirTag, and a plane ticket.” When cash and carry beats Swift, we’ve got a trust problem. But it’s not all grim, projects from SWIFT gpi to BIS Project Nexus, tokenised deposits, and JP Morgan’s JPM Coin, are showing examples of finally shifting from pilot to platform.

We also published our summary of BAFT’s Global Annual Meeting, which covered insights on trade fragmentation, compliance overload, and what ‘cooperation’ really means in a multipolar world. Meanwhile, the G7’s ECAs huddled in London, fintechs went blockchain in the UAE, and Allianz broke down what the US’s latest trade deals with China, the UK, and the Gulf might actually mean for exporters.

Treasurers weren’t left behind. Finastra’s divestment of its TCM unit to Apax signals a reshuffling in treasury tech, and HSBC’s tokenised deposits launch in Hong Kong shows how financial infrastructure is finally catching up to corporate demand for 24/7, cross-border liquidity — minus the panic.

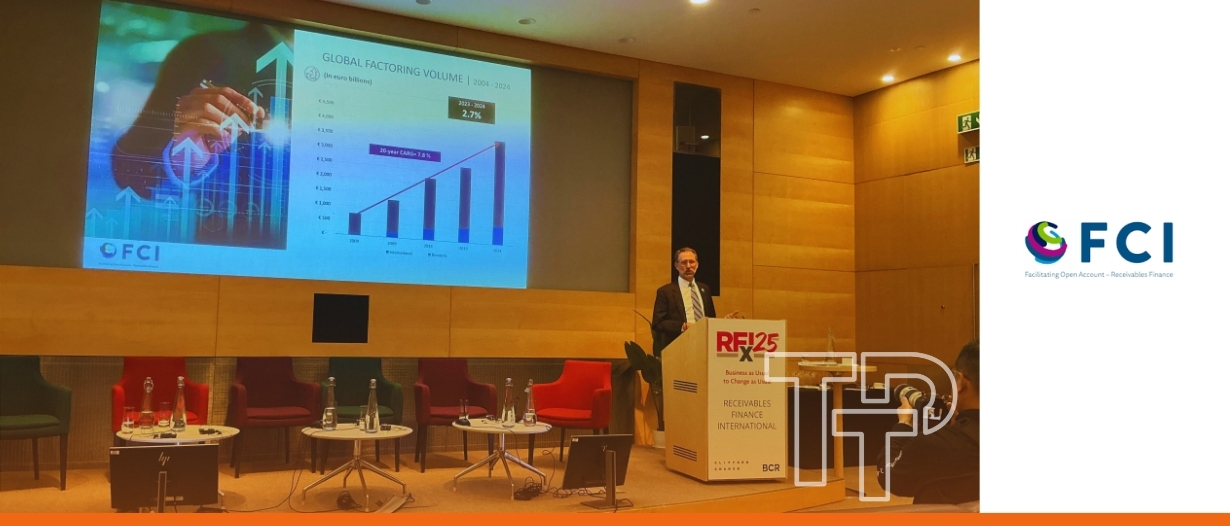

In the numbers: global factoring grew 2.7% in 2024 to €3.89 trillion, proving yet again that in uncertain times, factoring continues to grow.

Our editorial spotlight? Cash management in a 24/7 world — as explained by Crédit Agricole’s Stéphanie Delliste. Plus, stablecoins, MiCA, and whether digital dollarisation could upend emerging market monetary policy.

In the next couple of weeks, we’ll be prepping for Money 20/20 Europe in Amsterdam. We also have a very special interview which we will broadcast, but you’ll have to keep your eyes on TTP for that one.

Till then — keep it transparent.

— The Editors

Skip to your favourite part

Slow read

When cross-border payment systems work well, an exporter in Toronto can be paid by a buyer in Tokyo as easily as if the two were in the same city. That is one of the many reasons why these systems are often described as the lifeblood of global commerce.

For treasury and payments professionals, achieving this goal of making international payments feel as easy and reliable as domestic is motivating banks, fintechs, and regulators alike to improve the cross-border experience for their clients.

Yet industry veterans know we are not there yet. Cross-border transactions can still be painfully slow or unpredictable compared to local payments, and there is intense pressure in the industry to modernise and remove pain points.

During the Cross Border Payments Deep Dive at the Payments Summit in Toronto, Inderpreet Batra, Managing Director & Senior Partner at the Boston Consulting Group spoke with Matthew Parker-Jones, SVP, Global Head of Product Management – Global Transaction Banking at Scotiabank; Abhinav Natarajan, Executive Director, Global Product Lead; Kinexys Digital Payments at JP Morgan; and Elena Casal, Chief Client Officer at The Clearing House in a panel discussion titled, Cross-border infrastructure trends & how infrastructures & FIs are innovating in cross-border flows.

A fragmented and opaque payments landscape

Despite their importance, today’s cross-border payment rails can be rather fragmented and opaque. A myriad of intermediaries, like correspondent banks, clearing systems, or FX converters, are often involved in a single transaction, raising fees and hampering visibility for both the sender and receiver. For nearly a quarter of global payment corridors, fees still exceed 3%, and one-third of retail cross-border payments took more than one business day to settle in 2024.

Adding to this, businesses often don’t know upfront what a cross-border payment will cost or when exactly it will arrive. Charges can be added by intermediary banks without warning, and payment tracking is limited. An infuriating lack of clarity.

Indeed, new services like SWIFT gpi have introduced end-to-end tracking and confirmed delivery for international payments, but these are not yet universal. Many legacy corridors still operate on a “pay and pray” model where senders hope the payment reaches the beneficiary intact. In fact, the most reliable method of sending a large payment across any border in 2025 feels like something out of an old-school James Bond Movie.

One member of the panel said, “Does anybody know what the most reliable and guaranteed way to send $5000 around the world is? Not Swift, because Russia is not on Swift anymore. The most reliable way to send $5000 around the world in 24 hours is to get cash, put it in a briefcase, put an AirTag in that briefcase, buy a plane ticket, and fly it there… That’s the state of cross-border payments today.”

Modernising this is an urgent priority. Every extra hop or data handoff in a payment’s journey is a potential point of failure or added cost, and the reality is that clients don’t care how the money moves, just that it gets there fast and with no surprises.

There are several ideas for how to make this possible. One of which, building on new technological innovations, is the use of tokenisation and digital assets.

Tokenisation and digital assets

Tokenisation, which refers to representing money or assets as tokens on shared ledgers, is gaining prominence as a way to change payments and help in other aspects of the international economy, such as correspondent banking.

Blockchain and distributed ledger technology (DLT), the technologies often (though narrowly) associated with cryptocurrencies, underlie many such tokenisation initiatives. A wave of experimentation is underway, from banks issuing tokenised deposits to central banks exploring wholesale CBDCs (central bank digital currencies) for interbank settlement.

The BIS, for example, recently launched Project Nexus to link domestic instant payment systems across borders, aiming for payments in 60 seconds or less. Another BIS project, Project mBridge, is testing cross-border CBDC payments in Asia, and Project Agorá is examining how tokenised deposits and central bank money could work together on new ledgers.

Private sector players are also innovating. JP Morgan’s JPM Coin platform is designed to enable 24/7 intrabank cross-border transfers, and stablecoin issuers are partnering with fintech firms on cross-border remittances using digital dollars.

Stablecoins (privately issued digital currencies typically pegged to fiat) have attracted both interest and caution from the industry. On one hand, regulated stablecoins (like those meeting new EU MiCA rules) could provide faster settlement and 24/7 availability, plugging gaps when banks are closed. On the other hand, if stablecoins grow without proper oversight, they could introduce new risks.

An unchecked proliferation, especially since 99% of stablecoin value is USD-denominated, could even lead to “digital dollarisation” in some countries, where local economies start relying on USD stablecoins instead of the national currency. That would undermine local monetary policy and stability.

Trade digest

Treasury digest

Payments digest

🗓️ Upcoming events

Money 20/20 Europe TTP’s Joy Macknight will be covering Money 2020. Grab a coffee with her here.

| ITFA Americas TTP’s Carter Hoffman will be attending. Grab a coffee with him here.

|

ICC United Kingdom Sustainability Conference

| Tashkent International Investment Forum

|

FCI and IFC International Factoring and Reverse Factoring Seminar

| ICC Mexican Trade Finance Day

|

FCI Annual Conference Rio will host the FCI Annual Conference, covering the latest in factoring and Supply Chain Finance.

| ITFA Week Day 1

|

ITFA Week Day 2 and 3

| ITFA Annual Conference

|

ADB Annual Awards and Dinner

| SME Finance Forum

|

Sibos

|

Multimedia from Trade Treasury Payments

Videos

Podcasts

🏆 Missed our broadcast? Watch the replay of: Tariffs, treasury and trade finance

TTP’s Editor-in-Chief, Deepesh Patel, hosted a 30-minute livestream featuring Dmitry Grozoubinski (Aurora Macro Strategies), George Riddell (Goyder Ltd), and Leah N. Scarpelli (ArentFox Schiff LLP) to unpack the pressures reshaping global trade — from resurgent tariffs to treasury turmoil. Watch the replay here.

🏆 Meet the Global Advisory Panel (GAP)

| Wayne Mills, Open Account Advisory Panel MemberDaily Mission

Superpowers

Behind the Scenes

Life Mantras

|

Did You Know? Trade credit insurance is now the second most used method for banks to mitigate risk globally—up from near invisibility just a decade ago.

Till next time,