- Trade Treasury Payments | The Liquidity Brief

- Posts

- TTP | Issue 07

TTP | Issue 07

Curb your Monday blues with our liquidity brief. The only newsletter in liquidity and risk management that you need to subscribe to. For the hustler, the CEO, the intern, the MD. Prepare for your week ahead, with the biggest voices, heavyweight leaders, and the meaningful conversations in trade, treasury, and payments. No spin, no bias, no gatekeeping—just honest, high-value insights.

🌟 Editor's note

Editor’s Note | Week of 2 June 2025

In the run-up to Amsterdam, the fintech crowd is buzzing, and not just because Scarlett Sieber name-checked “collaboration” as this decade’s defining advantage. At TTP, we’ve had our bags packed for weeks. Money20/20 Europe is here, and it’s not just a fintech show anymore, it’s where pipes, policies, and platforms meet. Keywords: Embedded payments, AI-led infrastructure, regulation, fraud.

In our lead feature this week, Scarlett (CSGO of Money20/20 and ex-NASA) speaks to TTP’s Joy Macknight, outlining why embedded finance is becoming invisible and why regulators need to move from observation to co-creation. One takeaway? The future of fintech won’t be won by tech alone. Banks, policymakers, and innovators have to work together, or gaps will grow wider.

And speaking of gaps: trade and treasury professionals are still stuck managing cross-border payment bottlenecks, legacy SCF practices, and overlapping legal systems. In Australia and across APAC, new data from East & Partners shows supply chain finance on the up, with facility sizes expected to jump 40% in the next year. Meanwhile, a ruling in the US clipped Trump-era tariff powers, even as the WTO prepares for a showdown over the EU’s €2.1bn carbon border tax.

In the payments world, platforms are consolidating and accelerating. Trans-Fi and ACI launched global B2B infrastructure upgrades, and the FSB is now pushing for consistency in cross-border regulation — something banks have been begging for since Basel I.

We also covered the Netherlands’ move to formally legalise eBLs, Finceptive’s ₦3bn debt market entry in Nigeria, and a podcast deep dive on Lockton’s treasury resilience story.

TTP is live at Money20/20 Europe this week, covering embedded finance, tokenised payments, and the state of fintech-bank diplomacy. Follow Joy Macknight on the ground, and if you’re there, grab a coffee.

Till then — keep partnering.

— The Editors

Skip to your favourite part

Slow read

Scarlett has had a diverse career spanning banks, fintechs, tech start-ups, and includes a stint at US civil space agency NASA. At BBVA, for example, she was Senior Vice-President of Global Business Development, playing a key role in securing partnerships and accelerating the Spanish bank’s global innovation strategy in the US. She has recently published “Embedded Finance: When Payments Become an Experience”.

Trade Treasury Payments caught up with Sieber ahead of Money 20/20 Europe (June 3-5) to hear her views on the potential hot topics in Amsterdam, tips for successful fintech and bank partnerships, and why dialogue between regulators and industry players is critical in the payments space.

We asked Scarlett:

What are the big themes being discussed at Money 20/20 Europe this year?

What is the state of play when it comes to fintech and traditional bank collaboration?

What are your top tips for successful fintech and bank partnerships?

Where do you think fintechs are making the biggest impact in the payments space?

You’re speaking on a panel entitled ‘Space Odyssey: how tech’s new frontier is driving fintech’. How can fintech tap into emerging technology and think bigger?

What is key in the ongoing battle to keep regulation relevant?

Trade digest

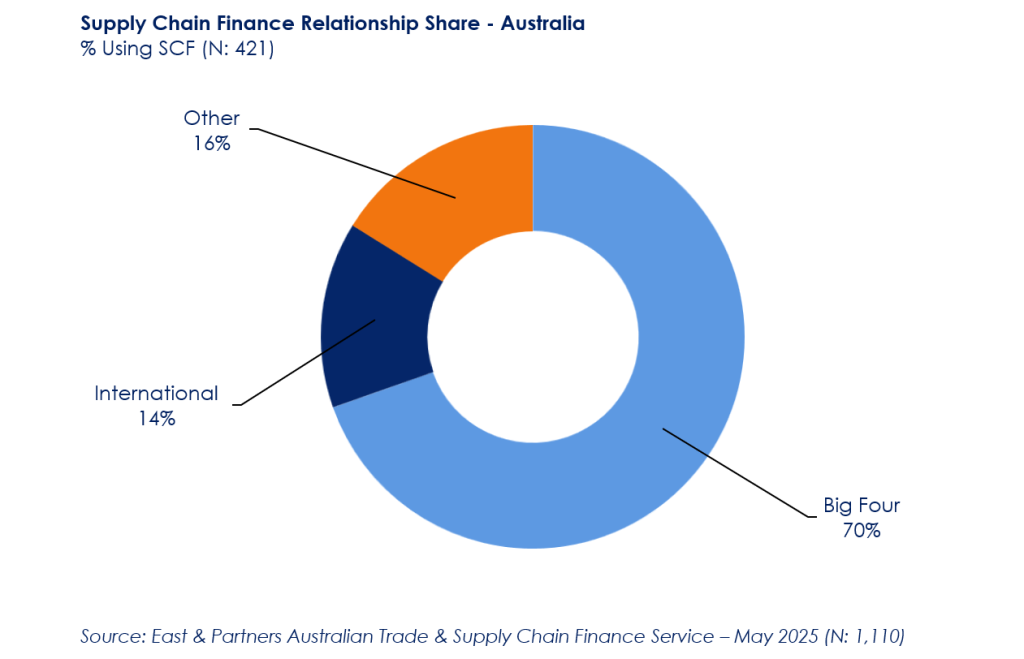

The research reveals among Commercial and Corporate enterprises that are actively using SCF who they are partnering with among Australian and international banks and what their current and forecast value of SCF facilities is. The Big Four majors cumulatively account for 70 percent of total SCF relationship share. International banks such as HSBC represent 14 percent and “Other” providers including non-bank trade financiers and regional lenders total 16 percent share.

With an average current SCF facility size of A$103.8 million market wide, this figure is forecast to expand strongly by 40 percent in the next year to A$144.9 million. How is this distributed by sector vertical?

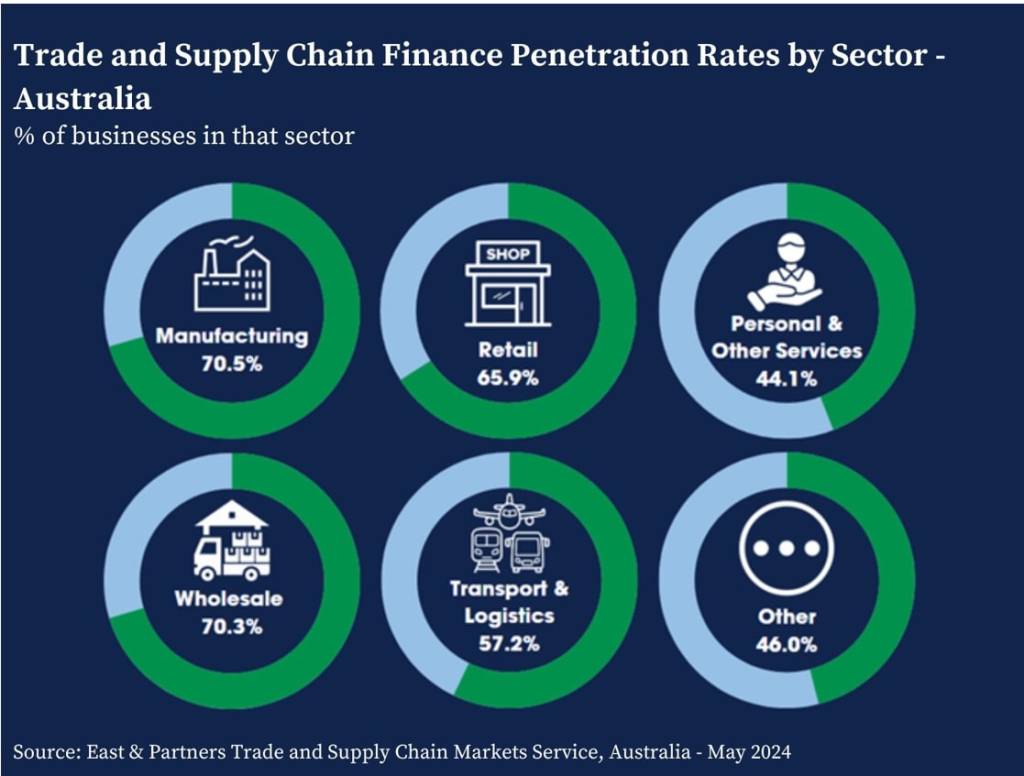

Recent East & Partners research reveals sharp differences in trade and supply chain finance penetration across Australian industries and further afield in the APAC region more broadly.

The Australian manufacturing sector is the most “open” to international trade with 7 in 10 actively importing or exporting (71 percent). This figure rises to 82 percent in Singapore and as high as 85 percent in Hong Kong. In contrast under 57 percent of enterprises in the transport sector exhibit an active need for trade and supply chain finance, close to 50 percent in Singapore and Hong Kong.

Treasury & FX digest

Payments digest

🗓️ Upcoming events

Money 20/20 Europe TTP’s Joy Macknight will be covering Money 2020. Grab a coffee with her here.

| ITFA Americas TTP’s Carter Hoffman will be attending. Grab a coffee with him here.

|

ICC United Kingdom Sustainability Conference

| Tashkent International Investment Forum

|

FCI and IFC International Factoring and Reverse Factoring Seminar

| ICC Mexican Trade Finance Day

|

FCI Annual Conference Rio will host the FCI Annual Conference, covering the latest in factoring and Supply Chain Finance.

| ITFA Week Day 1

|

ITFA Week Day 2 and 3

| ITFA Annual Conference

|

ADB Annual Awards and Dinner

| SME Finance Forum

|

Sibos

|

Multimedia from Trade Treasury Payments

Videos

Podcasts

New guide - The history of tariffs

TTP’s Trade & Technology Editor Carter Hoffman, on the history of tariffs.

Launching this week, look out for it here.

🏆 Meet the Global Advisory Panel (GAP)

| Robert Besseling, MENA Advisory Panel MemberDaily Mission: - Entrepreneur, globetrotter, and public speaker - Investing in future-proofing trade and promoting professional diversity initiatives - Trying to make a difference every day, otherwise I won't sleep (it's exhausting!) Behind the scenes: - Foodie, nature, beach, and animal lover - I am not a city boy! - I am happiest at home, surrounded by dogs, and a garden Life mantras: - "Who am I kidding, I do not live by mantras..." Hidden facts: - I was meant to become a classicist and ancient historian, but lost my way... - This was the hardest thing I have had to write in years! |

Company Spotlight: Bracket

Bracket: The fintech disrupting FX benchmarking for corporate treasurers

Elevator pitch: Bracket is a fintech platform that provides FX portfolio management for corporates and institutions. It features live mark-to-market data and stress testing capabilities.

Spot the difference: Different to the usual FX offering, Bracket offers FX benchmarking technology that analyses spot, forward and derivative pricing, both live and historical. Thumbs up for transparency.

Fun fact: The founders, Alex Charles and Pierre Anderson, came up with the idea of Bracket after 5 pints of Guinness in the Punch and Judy Pub in Covent Garden in 2017.

Did You Know? The average supply chain finance facility in APAC is now worth A$103.8 million, and is projected to grow 40% in just one year to A$144.9 million.

Till next time,