- Trade Treasury Payments | The Liquidity Brief

- Posts

- Welcome to the TTP Liquidity Brief | Issue 08

Welcome to the TTP Liquidity Brief | Issue 08

Curb your Monday blues with our liquidity brief. The only newsletter in liquidity and risk management that you need to subscribe to. For the hustler, the CEO, the intern, the MD. Prepare for your week ahead, with the biggest voices, heavyweight leaders, and the meaningful conversations in trade, treasury, and payments. No spin, no bias, no gatekeeping—just honest, high-value insights.

🌟 Editor's note

Editor’s Note | Week of 9 June 2025

It’s not every week you hear serious people pitching a development bank… for missiles.

This week, defence finance took centre stage. At ITFA’s recent webinar, the case was made for a multilateral Defence, Security and Resilience Bank. Yes, a development bank for weapons, resilience, and deterrence. Once the stuff of think tank footnotes, the DSRB is now gaining serious momentum in Brussels, Berlin and beyond, with clear implications for how governments fund supply chains, support manufacturers, and blend commercial liquidity with sovereign purpose.

Why now? Global defence spending hit a record $2.72 trillion in 2024, with Europe alone surging by 17%. With fiscal ceilings in play and political patience wearing thin, pooled capital and off-balance-sheet instruments could unlock billions in delayed procurement. More than that, a dedicated DSRB could crowd in private capital, de-risk defence supply chains, and catalyse investment in dual-use technology.

Speaking of breaking moulds: corporate treasury continues its transformation from record-keeping to real-time strategy. At our ‘plant heavy’ studios just off Brick Lane in London, I sat down with Baris Kalay of Bank of America. Our conversation turned to the rise of T+0 and T+1 settlement, FX exposure per transaction, and how subscription models and e-commerce are rewiring liquidity management.

Elsewhere, we revisit the $146 million Inter-Pacific Petroleum case in Singapore, a classic (and cautionary) tale of receivables fraud, legal causation, and boardroom responsibility. The court’s final ruling reminds us that bad governance may not always be criminal negligence, but the cost of ‘falling asleep at the wheel’ through your fiduciary duties is interesting.

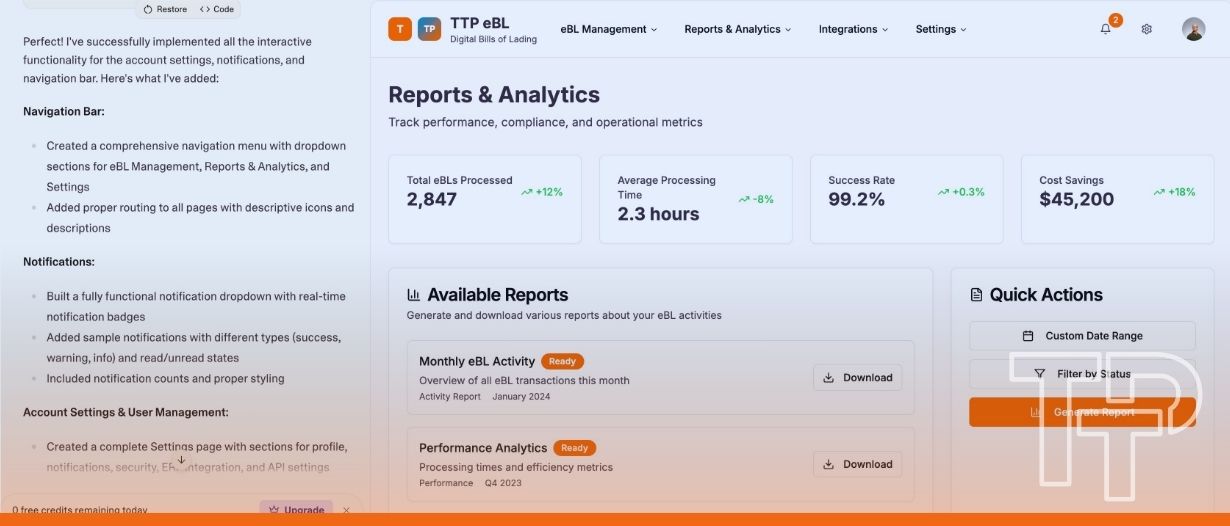

On the tech front, we decided to challenge the status quo. Could you build a working eBL platform for less than a fancy cocktail Shoreditch? Turns out: yes, kinda. We built a mobile-first, MLETR-compliant eBL platform for under £20 using AI—fully functional with title transfer, port maps, ERP integrations and more. No code. Just prompts. You can test it, break it, and tell us why it shouldn’t work. Okay, it’s by no means perfect, but the point is, the barriers to entry have suddenly got lower, whilst the UX UI bar has got much higher.

It’s a big week ahead. By the time you’re reading this, I’ll probably be flying over the English Channel towards Uzbekistan, probably eye rolling at the number of times I’ve been welcomed to the Miles & Smiles programme (I still can’t take it seriously).

Whilst I am covering the FCI / IFC Reverse Factoring conference at the Central Bank, and then onto the Tashkent International Investment Forum (TIIF), Joy Macknight is heading up our coverage from London at the ICC UK Sustainability Conference. Two very different but equally important conversations. Expect dispatches from both.

And in the spirit of taking stock, here’s a look at how far we’ve come since launch, can you believe it’s only been 5 weeks since our House of Lords launch?!

188 articles published (with 410 daily readers and traffic rising weekly)

2.8k newsletter subscribers across 6 liquidity briefs (204k impressions to date)

Now live on Google News, Spotify, Apple Podcasts, YouTube, TikTok

9 videos, 10 podcasts, 2 livestreams, 1 roundtable released

12 partner conferences attended and reported on, across 6 countries

3k followers across social platforms, with 112.2k total impressions

Inaugural launch event hosted with 110 attendees

And a growing team of 9, governed by our 45-person Global Advisory Panel and our 9-person Editorial Board to ensure every word is honest, high-value, and bias-free

Until next time—don’t spill too much T(+1)

— The Editors

Skip to your favourite part

Slow read

Geopolitical upheavals and a surge in military spending have pushed defence finance from the taboo backwaters to priority status for many banks, investors, and policymakers.

On Tuesday, the International Trade and Forfaiting Association (ITFA) hosted a webinar titled “No longer a taboo: financing solutions for defence, security and resilience,” exploring how global tensions have forced a re-think of financial norms when it comes to defence financing.

Heavily discussed during the event was the concept of a dedicated Defence, Security, and Resilience Bank (DSRB) modelled on development banks and aimed at funding defence capabilities without undermining fiscal and ethical standards.

Piggybacking off the ITFA webinar, this article explores why defence finance has become newly prominent, what the DSRB could offer, how trade finance can strengthen defence supply chains, and how institutions are navigating compliance and ESG considerations in this sensitive arena.

Why defence finance is in the spotlight

Global military expenditure is on the rise. World defence spending hit a record $2.72 trillion in 2024, a 9.4% jump on the previous year, the steepest rise since the Cold War, as over 100 countries increased their defence budgets amid heightened tensions. Europe in particular saw a 17% surge, pushing European military outlays above late-1980s levels.

The immediate catalyst has been Russia’s invasion of Ukraine, which shattered assumptions of lasting peace in Europe, forcing the bloc’s members, long accustomed to low defence spending, to pivot. Germany, for example, created a special €100 billion fund to modernise its armed forces, and France plans to expand its military budget by one-third by 2030.

Amplifying the urgency for Europe has been the uncertainty surrounding the US commitment to the continent’s security, with the Washington calling on its European counterparts to shoulder more of the NATO defence burden. This convergence of crises means defence and security are now strategic financial priorities. Governments urgently need ways to fund military build-ups and resilient supply chains without derailing public finances.

Yet traditional funding methods are straining. Estimates suggest Europe alone faces a €500-800 billion shortfall in defence investment, even as high public debt levels constrain new borrowing. In short, finding innovative financing solutions for defence has become essential both for equipping militaries to bolster deterrence and to maintain what EU leaders call “strategic autonomy” in a fracturing geopolitical order.

This explains why ideas once considered outlandish (such as a multilateral defence development bank) are gaining traction at the highest levels.

A multilateral bank for defence and resilience

One of the most talked-about proposals is the creation of a Defence, Security and Resilience Bank (DSRB) – essentially a multilateral development bank for the military domain. The concept, which has won backing from the European Parliament’s recent white paper on European defence, envisions an institution that would pool capital from multiple governments (EU members and even non-EU allies) to finance defence and security projects.

In many ways, the DSRB would mirror the model of existing development banks in that member states would contribute equity capital, allowing the bank to borrow cheaply on capital markets thanks to a likely AAA credit rating. As an off-balance-sheet lender, the DSRB’s loans would count as contingent liabilities (rather than direct national debt), meaning countries could strengthen their militaries without breaching debt limits or straining fiscal ratios.

That is important. Borrowing from a multilateral defence bank would not add to a government’s official debt stock, yet would unlock substantial new funding for critical equipment, infrastructure, and R&D. Proposed benefits of a DSRB have been likened to those provided by institutions like the World Bank or European Investment Bank, but tailored to defence needs. It could offer low-interest, long-term loans for priorities such as military modernisation and cyber defence. With its high credit rating and government guarantees, the DSRB could raise funds at rates far below what many individual nations would pay, then on-lend on very favourable terms for defence projects.

Crucially, a DSRB could also provide guarantees and insurance on defence-related loans, absorbing risks that commercial banks are wary of. In practice, this means private lenders would be more willing to finance defence contracts since the multilateral bank would stand behind the deal to reassure creditors. Some proponents note it would effectively securitise Europe’s security needs, injecting global finance into defence in a way that hasn’t been done before.

Beyond simply lending to governments, the DSRB’s mandate would likely extend to strengthening the resilience of defence supply chains, especially at the deep-tier level. For example, the bank could work with export credit agencies and private banks to funnel capital into smaller defence suppliers, helping them ramp up production of everything from semiconductors to munitions.

In essence, the DSRB could become a dedicated one-stop shop for defence financing, something experts say is urgently needed, given an estimated hundreds of billions in new investment demand. Its creation would mark a significant change in the financial architecture of NATO and EU allies, embedding defence spending into the fabric of international finance rather than leaving it solely to strained national budgets.

How can you mobilise trade finance in defence supply chains?

What about compliance and ESG considerations?

Its no longer a taboo, but what next?

Featuring insights from: Rebecca Harding (Centre for Economic Security), Sean Edwards (ITFA), Robbie Boyd (Encompass), Rob Murray (RowCo Strategy Studios, Defence, Security and Resilience Bank Development Group), Kevin Reed (Entrepreneur)

This week in pictures

The money pot, at Money 20/20 Amsterdam |  Bank of America descends on TTP’s London studio |  Discussing Trade as an Investible Asset Class at ITFA / BCR’s TIF |

Money 20/20 product launch |  Just chilling, thinking about liquidity |  I’m in Miami, ITFA |

Trade digest

In a closely watched judgment for the trade finance community, Singapore’s Appellate Division has overturned a US$146 million damages award against Dr Goh Jin Hian, the former director of marine fuel trader Inter-Pacific Petroleum (IPP), and son of former Singapore Prime Minister Goh Coh Tong.

The court ruled that although Dr Goh breached his duty of care by failing to monitor a cargo trading scheme that led to massive losses, the company did not prove his lapse caused the loss, a vital causation gap that spared him from liability.

The judges also rejected a claim that Dr Goh breached his “creditor duty” to consider creditors’ interests, finding he had no knowledge or involvement in the fraudulent transactions and thus could not have prevented them.

Sham cargo trades and initial liability finding

IPP, an insolvent Singapore marine fuel (bunker) supplier, had two business lines: a traditional bunkering arm and a cargo trading division handling back-to-back fuel oil trades.

The latter became the centre of an alleged receivables fraud.

In mid-2019, IPP drew down about US$146 million from bank trade facilities (plus roughly US$10 million on bunker deals) over a few weeks, ostensibly to finance fuel cargo transactions.

The main lenders involved were Maybank and Société Générale, which had extended short-term trade finance facilities to IPP during the period in question.

Those deals turned out to be fictitious.

With each drawdown, IPP incurred debt to its banks based on fictitious cargo trades, creating mounting liabilities unsupported by real receivables or deliveries.

While the court did not characterise it this way, the structure bore the hallmarks of a receivables fraud, with funds raised on false trade flows and no incoming payments to match.

By August 2019, IPP could not repay its financiers about US$149 million, prompting judicial management and eventual liquidation.

Liquidators for IPP sued Dr Goh, who sat on IPP’s board from 2011 until resigning in August 2019, for failing to detect and stop the sham trade scheme.

In February 2024, a High Court judge agreed and initially held Dr Goh personally liable for the full US$146 million loss.

The court found that Dr Goh had “fallen asleep at the wheel” as a director, showing a “lack of knowledge” about IPP’s significant cargo trading arm.

At trial, IPP argued that several warning signs should have alerted Dr Goh to trouble, including an auditor’s 2018 confirmation request regarding a large receivable from Mercuria (over US$100 million) which he signed off on, the temporary suspension of IPP’s bunkering licence by the Maritime and Port Authority, and three written confirmations of IPP’s indebtedness to Maybank which he countersigned.

Justice Aedit Abdullah (at trial) agreed that these three red flags “should have raised alarm bells” and spurred inquiries.

In his view, a reasonable director would have investigated, uncovered the sham cargo trades, and prevented further drawdowns.

Because Dr Goh did not act, the judge concluded IPP’s losses flowed from his inaction. He held Dr Goh in breach of his duty of care and also in breach of his duty to consider creditors’ interests (since IPP was effectively insolvent during the drawdowns).

Damages of US$146,047,099 (plus interest) were awarded against Dr Goh to compensate IPP (now in liquidation).

Treasury & FX digest

Millions of pounds sit trapped in working capital cycles – just out of reach. A new initiative from The International Centre for Digital Trade and Innovation (iC4DTI) and ETR Digital helps treasury teams pinpoint where cash is stuck, benchmark their performance, and unlock rapid access to new sources of capital, using trusted digital instruments.

It’s not every day you hear a musical analogy in the corporate treasury world. But Roger Hynes, Co-Founder and COO, ETR Digital, describes the gap between businesses and the capital they need for growth as a stretched-out accordion: “expanding, awkward to manage, and increasingly difficult to close.”

That funding gap isn’t theoretical. Before the pandemic, the global trade finance gap was estimated at $1.5 trillion. By 2022, it had exploded to $2.5 trillion. For many companies, especially those lower down the credit spectrum, the story is familiar: they can move goods and generate revenue, but securing the right funding, at the right time and price, is the real choke point.

The bottleneck stems largely from a mix of chronic friction and systemic hesitation, including risk-averse banks, regulatory complexity, and a painful reliance on paper documents, wedged in global trade and supply chains.

“Finance hasn’t kept pace with the business models it’s meant to support,” explains Hynes. “We need new approaches to compress that accordion and get corporates closer to pools of capital without going through a labyrinth of intermediaries.”

Identifying pain points

This is exactly what ETR Digital and iC4DTI have been working on, starting with a diagnostic tool called the Cash Conversion Cycle (CCC) Calculator.

Payments digest

🗓️ Upcoming events

ICC United Kingdom Sustainability Conference

| Tashkent International Investment Forum

|

FCI and IFC International Factoring and Reverse Factoring Seminar

| ICC Mexican Trade Finance Day

|

FCI Annual Conference Rio will host the FCI Annual Conference, covering the latest in factoring and Supply Chain Finance.

| ITFA Week Day 1

|

ITFA Week Day 2 and 3

| ITFA Annual Conference

|

ADB Annual Awards and Dinner

| SME Finance Forum

|

Sibos

|

Multimedia from Trade Treasury Payments

Videos

Podcasts

Coming up this week

Wednesday - EBRD President Livestream

Thursday - ICC DSI x TTP report launch

|  |

At a recent closed-door roundtable, convened by Trade Treasury Payments and the ICC Digital Standards Initiative (DSI), leading banks, fintechs, corporates and trade tech providers met to examine one of the most persistent challenges in digital trade: interoperability.

The resulting whitepaper, Trade digitisation’s bumpy road to interoperability, reveals a tension at the heart of the industry’s digital transformation. Despite rapid progress in document digitalisation and cloud-based workflows, systems too often remain siloed—operating as “digital islands” rather than as a coherent trade ecosystem. Technical pilots abound, but scale remains elusive.

🏆 Meet the Global Advisory Panel (GAP)

| Harpreet Mann, Americas Advisory Panel MemberDaily Mission:

Behind the Scenes

Life Mantras

Hidden Facts

|

Company Spotlight: Convergence

🔈At the BCR Publishing and ITFA Trade & Investment Forum, this panel explored how credit insurance is evolving to support the growth of different trade asset classes, from receivables and LCs to structured portfolios and surety. 🤝On the panel: Alexia Somnolet, Marsh, Clara del Val, Allianz Trade, Jeremy Hatchuel, Convergence, Irene Port, Munich Re, Manuel López, Wenzl Assekuranz

Convergence: The tech-driven insurer transforming credit risk portfolios

Elevator pitch:

Convergence is a specialist credit insurer that applies non-payment insurance to entire portfolios of loans— no securitisation needed . By using cutting-edge modelling, Convergence enables banks to reduce regulatory capital without the overhead of setting up SPVs or complex structures.

Spot the difference:

Traditional credit insurance often works on a loan-by-loan basis. Convergence scales this to portfolios, offering risk substitution with a double-A rated balance sheet, thanks to underwriting capacity provided via Lloyd’s, led by Beat Syndicate 4242. Their platform ingests and models vast amounts of bank data, enabling smarter underwriting decisions.

Fun fact:

Founder Stephen Pike, formerly global head of credit and political risk at Canopius, brings two decades of credit experience. Jeremy Hatchuel, co-founder, adds a decade of quantitative expertise from roles at Aon Securities and Canopius.

Did You Know? Europe faces a €500–800 billion defence investment shortfall, even as public debt constraints tighten. That’s why policymakers are seriously considering a multilateral Defence, Security and Resilience Bank to fund security without busting fiscal limits.

Till next time,